The largest aircraft manufacturer in the U.S., The Boeing Company (BA) delivered 34 planes in November and added 109 planes to its 737 MAX order tally, according to Reuters.

However, delivery of its 787 Dreamliners remains sidelined as it will undergo strict scrutiny and inspection due to manufacturing flaws detected earlier on.

Following the news, shares spiked 1.6% momentarily before closing the day down 1% at $195.50 on December 14.

See Analysts’ Top Stocks on TipRanks >>

November Delivery Status

In November, Boeing delivered 28 737 MAX jets, of which 10 were ordered by European low-cost flyer Ryanair Holdings (RYAAY). The rest were larger planes, one 767 each for delivery behemoths FedEx Corp. (FDX) and United Parcel Services (UPS), one 747-8 for the Egyptian defense ministry, and two 767 tankers for the U.S. Air Force.

For the eleven months ending November 30, Boeing delivered a total of 302 aircraft, more than double the deliveries undertaken during the same period last year.

Boeing had 109 gross orders for its 737 MAX jets, which resumed production in late 2020, after a nearly two-year safety ban. Out of the above, 72 MAX jet orders were from Indian carrier Akasa Air for a $9 billion deal, helping Boeing to regain strength in the Indian market. The company also delivered seven 737 MAXs for Southwest Airlines (LUV).

There were 18 cancelations for 737 MAX jets taking the order tally to between 373-457 after cancellations, conversions, and stricter accounting standards.

Analysts’ View

Responding to Boeing’s delivery update, Cowen & Co analyst Cai Rumohr, said, “November’s improving 737 delivery momentum was somewhat encouraging, but 787 still is paused. BA also reported 91 net MAX orders (ex ASC adjustments), the tenth straight month of positive bookings.”

Rumohr has a Buy rating on the stock and a price target of $250, which implies 27.9% upside potential to current levels.

With 13 Buys and 3 Holds, the stock commands a Strong Buy consensus rating. The average Boeing price target of $270.80 implies 38.5% upside potential to current levels. Shares have lost 14.8% over the past year.

Investors

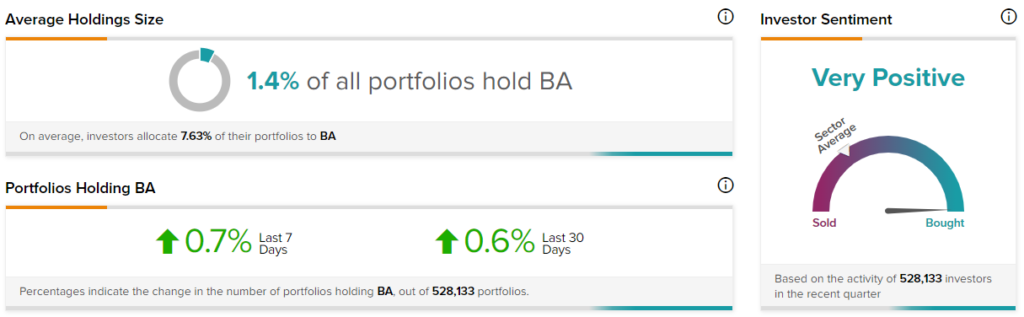

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Boeing, with 0.7% of portfolios tracked by TipRanks increasing their exposure to BA stock over the last 7 days.

Related News:

Meta Platforms Buys Name Rights for Meta

Starbucks China to Probe Expired Ingredients Usage

UBS Found Guilty in French Tax Case; Penalty Slashed to $2B