Boeing Co (BA) will lay off 400 employees at its aerospace manufacturing facility in Winnipeg as a result of the economic impact of the coronavirus pandemic.

“Due to the impact of the COVID-19 pandemic, Boeing previously announced we would adjust the size of our company to reflect new market realities through a combination of voluntary layoffs, natural turnover and involuntary layoffs,” Boeing spokeswoman Jessica Kowal said in a statement.

Boeing Winnipeg, which employs 1,600 workers is one of the largest aerospace composite manufacturers in Canada. At the site, Boeing produces over 500 end item composite parts for the company’s commercial airplanes. Major products include wing to body fairings, engine strut forward fairings, landing gear doors, and the engine inlet inner barrel of the new 737 MAX. In addition, Boeing Winnipeg designs and manufactures many parts for the 787 Dreamliner.

Earlier this month, Boeing reported that it did not receive a single order in April, while it was also grappling with 108 order cancelations for its grounded 737 MAX plane. Commercial airline travel has fallen off a cliff due to coronavirus-induced lockdown restrictions forcing many airlines around the world to ground the majority of their fleets, suspend aircraft deliveries, and streamline operations.

Shares in Boeing dropped another 1.1% to $137.53 on Friday taking this year’s slide to 59%.

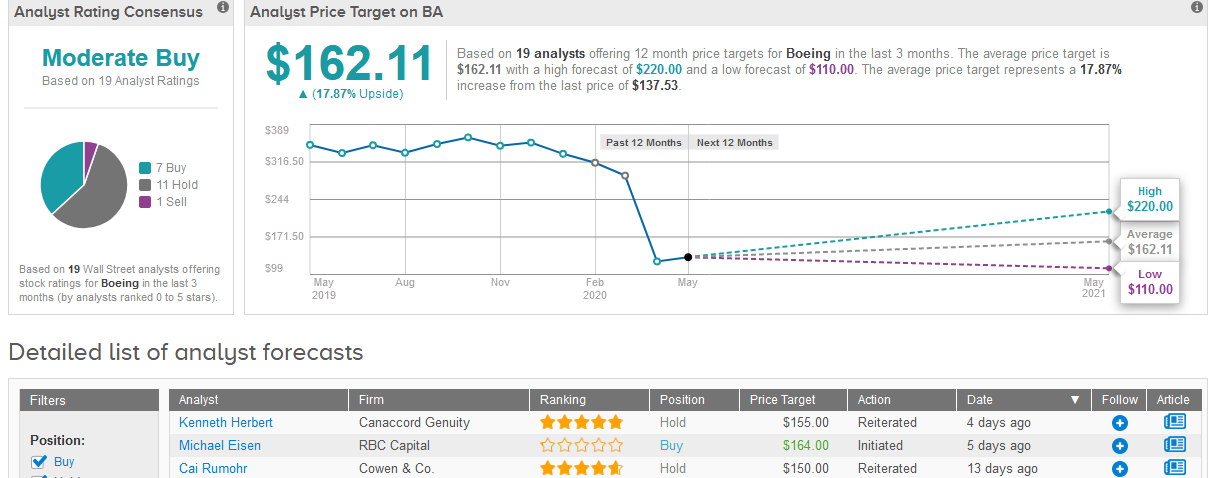

Despite the steep plunge this year, five-star analyst Kenneth Herbert at Canaccord Genuity still sees limited upside potential in the stock. The analyst last week sharply cut Boeing’s price target to $155 from $175, and maintained a Hold rating, saying that the outlook is now very depressed with expectations of more negative news flow.

“While BA has come back from the financial cliff, we see limited opportunity for capital allocation to be a catalyst for the stock, and we believe Boeing now has little flexibility to pursue new aircraft programs if necessary,” Herbert wrote in a note to investors. “We are still cautious on Boeing until we get better visibility on the pace of improvement in air travel and when airlines will start to order aircraft again.”

Turning now to the rest of the Wall Street, TipRanks data shows that overall analysts are cautiously optimistic on Boeing shares. The Moderate Buy consensus is based on 7 Buy ratings, 11 Hold ratings and 1 Sell rating. The $162.11 average price target implies 18% upside potential in the stock in the next 12 months. (See Boeing’s stock analysis on TipRanks).

Related News:

Ryanair Cuts Traffic Target By Almost 50% For Coming Year, Seeks To Reduce Boeing Plane Deliveries

Boeing Gets No Orders in April, Customers Cancel 737 MAX Jets

Colombian Carrier Avianca Files for Bankruptcy Protection Due to Coronavirus Woes