American alternative investment management company Blackstone (NYSE: BX) has priced its $500 million, 2.55% senior notes due in 2032, and $1 billion of indirect subsidiary Blackstone Holdings Finance Co.’s 3.2% senior notes due in 2052.

Proceeds from the total $1.5 billion offering are expected to be used for general corporate purposes.

Blackstone is expected to release its upcoming earnings report for the final quarter of 2021 on January 27, 2022.

Wall Street’s Take

With a positive stance on the sector in 2022, Deutsche Bank analyst Brian Bedell recently maintained a Buy rating on the stock and lifted the price target to $190 (50.04% upside potential) from $152.

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 8 Buys and 4 Holds. The average Blackstone price target of $154.55 implies 22.05% upside potential. Shares have gained 31.6% over the past six months.

Risk Analysis

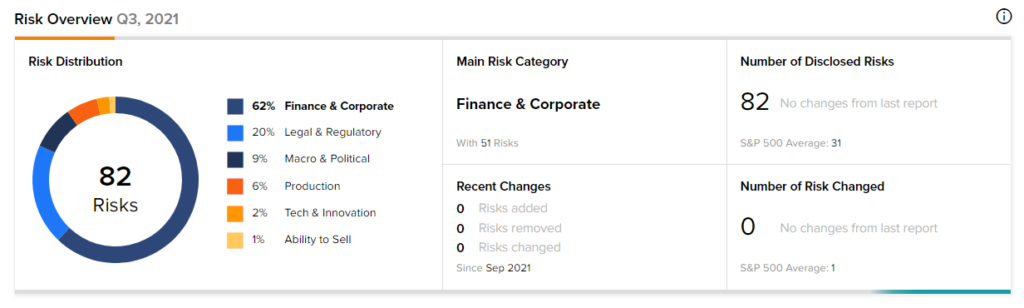

According to the new TipRanks Risk Factors tool, Blackstone stock is at risk mainly from two factors: Finance and Corporate, and Legal and Regulatory, which contribute 62% and 20%, respectively, to the total 82 risks identified for the stock.

Download the mobile app now, available on iOS and Android

Related News:

Apple Secures Top Spot for Phone Sales in China – Report

Tesla Records Over 300,000 Deliveries in Q4, Beats Expectations

NIO Notifies Shareholders of Convertible Notes Option