BlackBerry (BB) posted lower revenue in the first quarter of 2022 compared to a year ago but not as much as analysts anticipated. Losses were in line with estimates.

Revenue came in at $174 million in Q1 2022, down 16% from $206 million in Q1 2021. Analysts expected revenue of $171.25 million. Demand for BlackBerry’s QNX operating software and cybersecurity products has risen as businesses increasingly switch to cloud computing to support remote working during the pandemic.

Gross margin decreased to 65.5% from 69.4% in the previous year.

Meanwhile, net loss narrowed to $62 million ($0.11 per share) from $636 million ($1.14) per share a year earlier.

On an adjusted basis the company lost $0.05 per share, compared to earnings of $0.01 in the prior-year quarter.

BlackBerry Executive Chairman and CEO said, “This quarter we aligned the business around the two key market opportunities – IoT and Cyber Security. In IoT we are pleased with the strong progress of the auto business, despite global chip shortage headwinds. Design activity remains strong, the number of vehicles with QNX software embedded has increased to 195 million, and royalty revenue backlog grew by 9% year-over-year. Tangible progress continues to be made with BlackBerry IVY, including the launch of the IVY Advisory Council and the first investment by the IVY Innovation Fund. On the Cyber Security side, we announced two new significant product launches as part of our XDR strategy – BlackBerry Gateway and Optics 3.0. We continue to see strong pipeline growth for our new UES products.” (See BlackBerry stock chart on TipRanks)

Earlier this week, RBC Capital analyst Paul Treiber kept a Sell rating on BB with a C$9.24 target price. This implies 41% downside potential.

Treiber believes that normalization of investor sentiment on BlackBerry is a potential risk for the stock after a significant rally since its fourth-quarter earnings release.

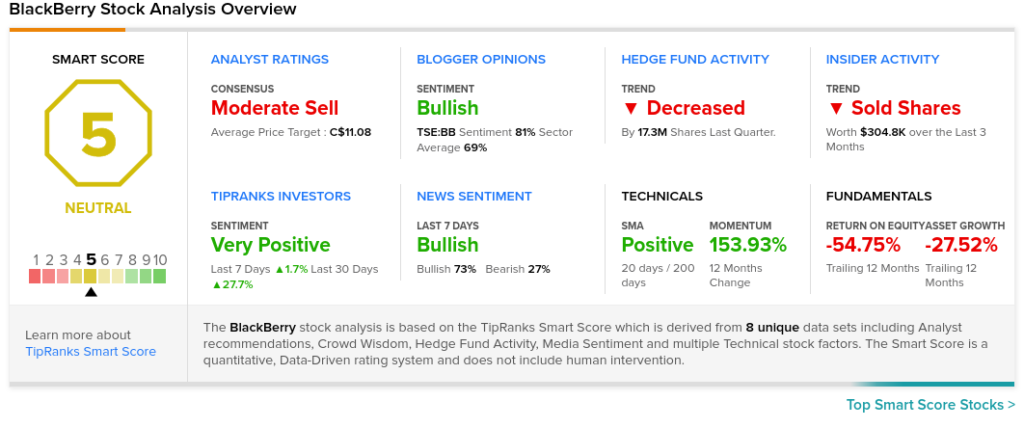

Overall, BB scores a Moderate Sell rating among Wall Street analysts based on 2 Holds and 1 Sell. The average BlackBerry analyst price target of C$11.08 implies 29.2% downside potential to current levels.

TipRanks’ Smart Score

BB scores a 5 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock’s returns are likely to be in line with the overall market.

Related News:

BlackBerry Earnings Preview: Here’s What to Watch for

Alithya Loss Narrows in Q4, Sales Hit Record

Lightspeed to Acquire Two E-Commerce Platforms for $925 M; Street Says Buy