BiomX Inc. (PHGE) reported a Q1 loss of $0.35 per share as compared to a loss of $0.26 per share reported in the prior year’s quarter. Shares jumped as much as 6% on the news and closed at $6.19 on May 24, up 1.6% from the previous day.

BiomX is a clinical-stage microbiome company that engages in developing bacteriophage-based therapies for the treatment and prevention of diseases stemming from dysbiosis of the microbiome.

R&D expenses for the quarter stood at $5.79 million, up 64% from the prior year’s quarter. The increase was mainly due to a higher number of employees and their related expenses, together with higher expenses related to clinical activities and related trials. (See BiomX stock analysis on TipRanks)

Commenting on the results, Jonathon Solomon, CEO of BiomX said, “We are off to a strong start in 2021 and are well-positioned to continue making solid progress throughout our entire pipeline of novel phage therapies with the potential to make a significant impact in the microbiome space. Within the next 14 months, we will have clinical readouts in four distinct indications and remain committed to advancing our phage therapies that have the potential to restore health to the microbiome and in turn, provide safe and effective treatments to patients in need,”

H.C. Wainwright analyst Joseph Pantginis maintained a Buy rating on the stock with a price target of $20, which implies a massive 223.1% upside potential to current levels.

Pantginis believes the company’s pipeline buzz builds with four upcoming clinical catalysts and states,“ The key focus for BiomX, in our opinion, remains delivering major clinical catalysts, and the company expects to disclose four key readouts over the next 14 months including: (1) the aforementioned Phase 2 acne data; 8- and 12-week data in 3Q21 and 4Q21, respectively; (2) Phase 1b/2a cystic fibrosis (CF) data with a readout from part 1 in 1Q22 and results from part 2 anticipated in 2Q22; (3) Phase 2 proof-of-concept atopic dermatitis (AD) data in 1H22; and (4) Phase 1b/2a IBD/PSC data in mid-2022.”

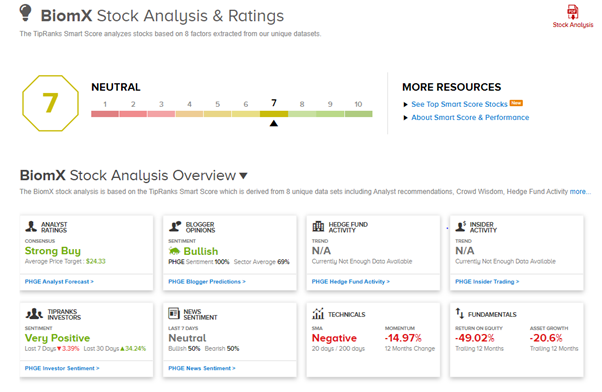

Consensus among analysts is a Strong Buy based on 3 unanimous Buys. The average analyst price target stands at $24.33 and implies upside potential of 293% to current levels. Shares have lost around 1% over the past year.

According to TipRanks’ Smart Score system, BiomX gets a 7 out of 10, which indicates that the stock is likely to perform in line with market averages.

Related News:

KKR Snaps Up Three-Building Portfolio In Phoenix

Ormat to Buy Two Geothermal Assets and a Transmission Line for $377M

StoneCo Signs $471M Investment Agreement With Banco Inter