Billionaire hedge fund manager Bill Ackman’s Pershing Square Capital Management Ltd. has bought a $25 million stake in private equity firm Blackstone Group Inc. (BX) in the first quarter.

Pershing Square said it built a position of almost 549,000 shares of Blackstone, according to a SEC filing. In addition, the billionaire’s portfolio disclosed a new position in Park Hotels & Resorts Inc. (PK), in which it bought 678,000 shares, valued at about $5.4 million, as of March 31.

Shares in Blackstone this year slumped as much as 35% as of March 23. However, since then the stock has seen a nice recovery soaring 42% and trading at $51.07 as of Friday. In the first quarter of the year, Park Hotels shares have lost as much as 81%.

The hedge fund manager has also taken some profits. During the first quarter, Pershing divested about 32% of the portfolio’s stake in Chipotle Mexican Grill (CMG). The value of the burrito chain’s shares has more than doubled in the past two months. Furthermore, Ackman bumped up investments in current holdings, including Starbucks (SBUX), Agilent Technologies Inc. (A), Lowes Companies (LOW) and Restaurant Brands International (QSR).

Despite strong stock market volatility triggered by the coronavirus pandemic, Pershing’s portfolio this year returned 16.5% on its investments as of May 12.

At the beginning of the year, billionaire investor Ackman moved to protect the firm’s stock portfolio against coronavirus-related panic selling in markets by buying credit default swaps. Pershing Square yielded a stellar $2.6 billion from hedging its stock portfolio through the credit protection. Most of the return was invested in buying more shares of the fund’s portfolio companies including, Hilton Worldwide Holdings Inc. (HLT) and Warren Buffet’s Berkshire Hathaway (BRK.A).

Ackman is this year also upbeat about investment into infrastructure projects helping the U.S. economy recover from the repercussions of the coronavirus outbreak. In March, Pershing invested $500 million in Howard Hughes Corp. (HHC), one of the largest real estate development companies in the US.

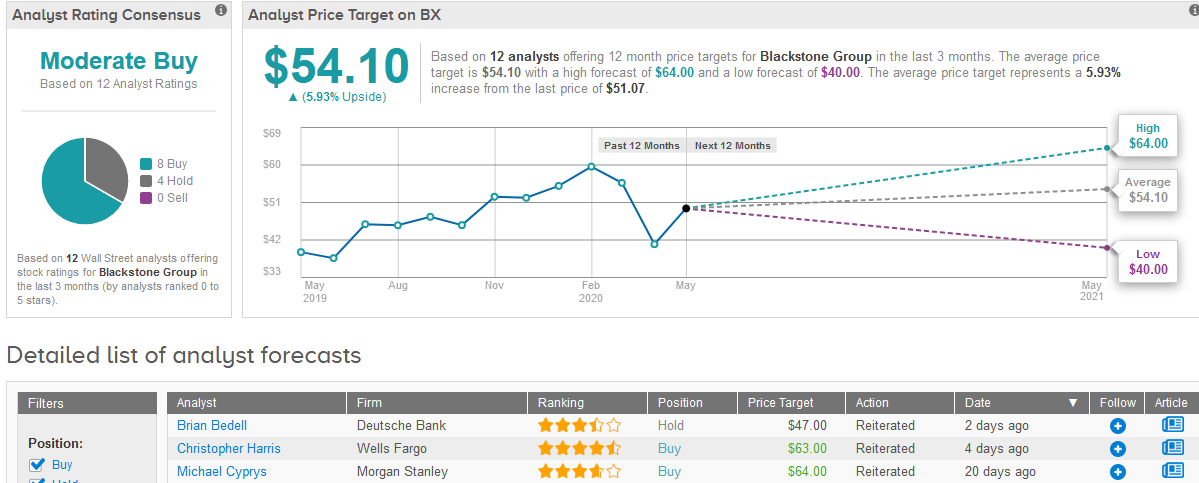

Last week, both Brian Bedell at Deutsche Bank and Christopher Harris at Wells Fargo raised Blackstone’s price target to $47 and $63 respectively from $43 and $58 previously. Bedell has a Hold rating on the stock while Harris views it as a Buy.

Overall, TipRanks data shows that Wall Street analysts are cautiously optimistic about the shares with 8 Buys and 4 Holds adding up to a Moderate Buy consensus. The $54.10 average price target implies 5.9% upside potential over the coming year. (See Blackstone stock analysis on TipRanks).

Related News:

Buffett’s Berkshire Shaves Off 84% Of Its Goldman Sachs Stake

Carl Icahn Initiates Position in Delek US Holdings, Boosts Occidental Petroleum

Is Royal Caribbean Cruises (RCL) Stock a Buy? This Analyst Says Yes