American merchandise retailer Bed Bath & Beyond Inc. (NASDAQ: BBBY) delivered disappointing third-quarter results due to the persistent supply chain issues, which affected its ability to stock merchandise. These issues led to a $100 million impact in the quarter, and BBBY expects an even higher impact from these issues in December.

However, shares gained as much as 22.5% during intraday as the Meme stock investors pushed the stock up due to high short-selling interest. Meanwhile, shares were down almost 9% during pre-market trading when the company released its results. After having a volatile day, BBBY stock ended the day up 8% at $14.43 on January 6.

Disappointing Results

The company reported an adjusted quarterly loss of $0.25 per share, worse than the analysts’ estimates of $0.00 per share. In the prior-year quarter, BBBY posted an adjusted quarterly profit of 0.08 per share.

Furthermore, net sales declined 28% year-over-year to $1.88 billion, falling short of analysts’ estimates of $1.96 billion. On a core sales basis, net sales fell 14% year-over-year due to the planned divestments of the non-core businesses. Meanwhile, comparable sales also fell 7% compared to Q3FY20.

However, the company was able to report gross margins of 35.6%, aided by a market-driven pricing strategy undertaken to offset supply chain and freight issues.

CEO Comments

President and CEO of BBBY, Mark Tritton, said, “Our customer acquisition strategy for the Bed Bath banner is gaining traction as evidenced by our Beyond+ loyalty program, which grew by nearly half a million members after one of our largest new subscriber quarters.”

Tritton added, “In response to a sharp increase in inflation and pervasive freight and supply chain headwinds, we swiftly implemented market-driven pricing, promo optimization, and product mix plans. Our decisive actions led to an adjusted gross margin rate significantly exceeding plan and above 2020 and 2019… As we prepare for 2022, we look forward to operating in a normalized environment with a base of business upon which to grow.”

Reaffirmed Q4 & Revised FY21 Guidance

Based on the current business momentum, BBBY expects Q4 net sales of $2.1 billion, lower than the consensus estimate of $2.27 billion. Q4 adjusted earnings are projected to be between $0.00 and $0.15 per share, significantly lower than consensus estimate of $0.72 per share.

Based on its year-to-date performance, BBBY now projects full-year fiscal 2021 net sales to be $7.9 billion and adjusted earnings to be between ($0.15) and $0.00 per share.

Analysts’ View

Responding to BBBY’s poor performance, Wells Fargo analyst Zachary Fadem said, “We believe fundamentals are deteriorating, long-term goals appear aggressive and cash appears to be dwindling into a period of heightened business investment.”

Fadem reiterated his Sell rating and $12 price target on the stock (16.8% downside potential).

The analyst added, “Despite encouraging new leadership and a thoughtful multi-year (FY21-23) plan, we view BBBY as a structurally challenged asset, visibility remains low and the path ahead likely remains bumpy.”

Overall, the stock has a Moderate Sell rating based on 1 Buy, 4 Holds, and 6 Sells. The average Bed Bath & Beyond price target of $14.67 implies 1.7% upside potential to current levels. However, shares have lost 23% over the past year.

Investors

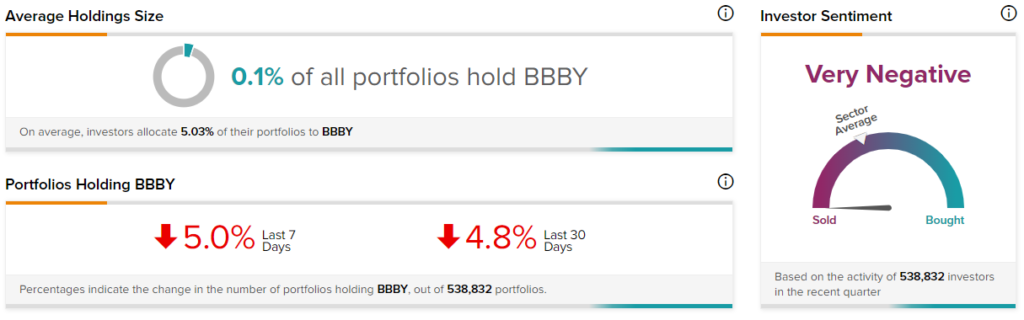

According to TipRanks’ Stock Investors tool, investors currently have a Very Negative stance on Bed Bath & Beyond. The stock volatility due to the meme stock frenzy has been high during the past year, and 5% of portfolios tracked by TipRanks decreased their exposure to BBBY stock during the last 7 days.

Download the TipRanks mobile app now

Related News:

Walmart to Add 3,000 Drivers to Bolster InHome Delivery; Shares Rise

GM’s BrightDrop Secures Commercial EV Orders from Walmart & FedEx

Airbnb Users Ask for Crypto Rentals in 2022; Shares Down 5%