Multinational healthcare company Baxter International, Inc. (BAX) has reported solid financial results for the third quarter of 2021. The Illinois-based company manufactures products to treat hemophilia, kidney disease, immune disorders and other chronic and acute medical conditions.

Adjusted earnings per share (EPS) increased 23% year-over-year to $1.02, beating the Street’s estimate of $0.94. Revenue grew 9% to $3.23 billion, in line with analysts’ expectations.

Domestic sales rose 6% year-over-year to $1.3 billion and international sales jumped 10% to $1.9 billion. (See Insiders’ Hot Stocks on TipRanks)

The Chairman, President and CEO at Baxter, José E. Almeida, said, “Baxter’s essential products, diverse portfolio and global scale continue to fuel our operations in 2021.”

Meanwhile, the company projects sales growth of 3% to 4% for the fourth quarter of 2021 and adjusted EPS to lie between $1 and $1.04.

For 2021, it expects sales to grow by 7% to 8% and adjusted EPS to range from $3.58 to $3.62.

After Baxter reached an agreement to acquire Hill-Rom (HRC) in early September, Barclays (BCS) analyst Travis Steed upgraded the rating on the stock to Buy from Hold and raised the price target to $100 from $93 (21% upside potential).

The analyst said, “Hill-Rom de-risks the Baxter story and creates opportunity.”

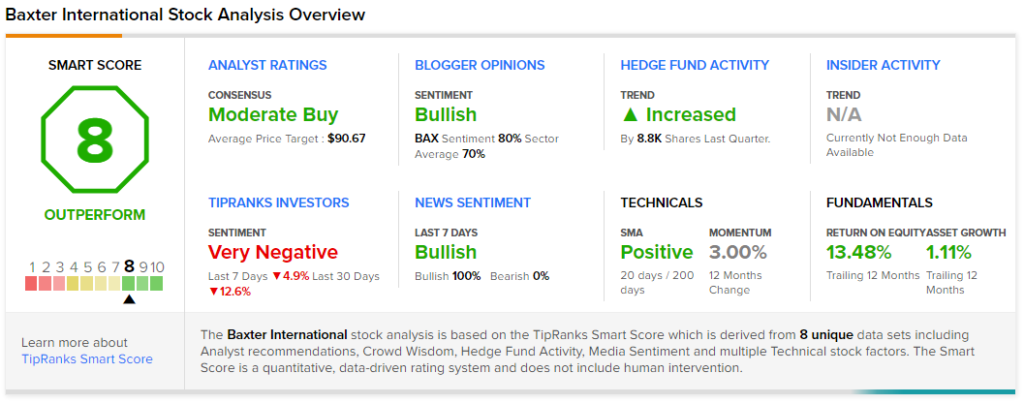

Overall, the stock has a Moderate Buy consensus rating based on 7 Buys and 3 Holds. The average Baxter International price target of $90.67 implies 10.7% upside potential. Shares have lost 5.8% over the past six months.

According to TipRanks’ Smart Score rating system, Baxter scores an 8 out of 10, suggesting that the stock is likely to outperform market averages.

Related News:

General Dynamics Posts Mixed Q3 Results

Despite Strong Q3 Results, Upwork Shares Drop 6.8%

Ford’s Q3 Results Exceed Expectations; Shares Jump 8.8%