Shares of Barrick Gold Corporation (NYSE: GOLD) jumped almost 8.7% to close at $20.17 on Wednesday, after the mining company revealed that its annual guidance has met the targets for the third consecutive year.

Despite challenges resulting from the persistence of the COVID-19 pandemic, the company posted strong preliminary full-year and fourth-quarter 2021 production results. Additional update on production and sales is expected to be released in the upcoming earnings report of the fourth quarter and full-year 2021 on February 16, 2022.

Headquartered in Canada, Barrick Gold produces gold and copper operating at 16 sites in 13 countries.

Full-Year 2021 Production Update

Gold production came in at 4.44 million ounces, within the company’s guidance range of 4.4 to 4.7 million ounces. Markedly, both the Africa & Middle East and Latin America & Asia Pacific regions met the higher end of their regional gold production expectations.

Additionally, preliminary copper production of 415 million pounds stood within the guidance range of 410 to 460 million pounds.

Q4 Update

For the fourth quarter of 2021, Barrick Gold recorded sales of 1.23 million ounces of gold and 113 million pounds of copper, wherein preliminary Q4 production came in at 1.20 million ounces of gold and 126 million pounds of copper.

Markedly, outstanding performance at the Carlin and Cortez mines in Nevada improved the company’s gold production in the quarter, compared with the prior quarter.

The company expects a 4%-6% reduction in all-in sustaining costs (AISC) per ounce of gold on a sequential basis, while copper all-in sustaining costs per pound are anticipated to scale higher by 11%-13%. AISC refers to all the sustaining expenditures incurred in the production process.

Wall Street’s Take

On January 10, RBC Capital analyst Josh Wolfson maintained a Buy rating and a price target of $23 (14.03% upside potential) on Barrick Gold.

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 8 Buys and 3 Holds. The average Barrick Gold stock price prediction of $25.80 implies 27.91% upside potential. Shares have lost 11.6% over the past year.

Bloggers Weigh In

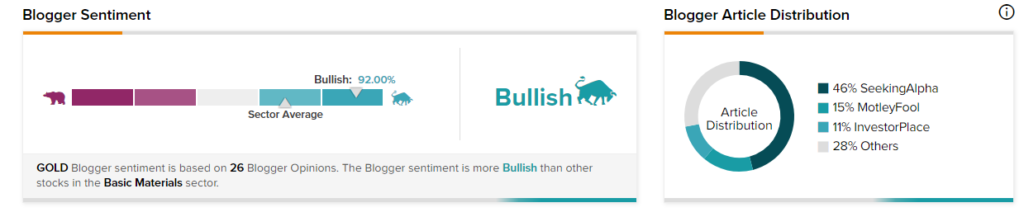

TipRanks data shows that financial blogger opinions are 92% Bullish on GOLD, compared to a sector average of 69%.

Bloggers’ positive stance might encourage investors to add the GOLD stock to their portfolio. Markedly, an uptick in gold prices was recorded in the December quarter as investors sought safe-haven assets on concerns over inflation and the Omicron coronavirus variant.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

SoFi Gets Regulators’ Green Light to Become a National Bank

Apple Faces Another Lawsuit over 5G Patent Licensing – Report

Goldman Slumps 7% on Q4 Earnings Miss