Australia’s New Century Resources Ltd. is in talks with Brazilian miner Vale SA (VALE) for the acquisition of its nickel and cobalt mine operations on the Pacific island of New Caledonia.

The zinc miner has entered into a 60-day exclusivity period with Vale Canada Limited, a subsidiary of Vale S.A., to complete due diligence and negotiate the acquisition of 95% of the issued shares in Vale Nouvelle Calédonie S.A.S. (VNC), which owns and operates the Goro nickel & cobalt mine in New Caledonia. The mine also has a processing plant and a port facility.

Financial terms of the talks weren’t disclosed. However, Vale informed investors that with the announcement, the investment held at VNC will be recorded at the fair value and classified as an “asset held for sale” in its consolidated financial statements, leading to an additional impairment loss of about $400 million to be recognized in the second quarter income statement.

If the talks progress to a deal, the purchase would turn New Century Resources into a major supplier of nickel and non-DRC sourced cobalt for the electric vehicle industry, the zinc miner said.

Furthermore, IGO Limited, a major shareholder in New Century, is supportive of the acquisition opportunity, New Century said in the statement.

Shares in Vale have seen a nice advance in the past two months gaining 36%. However, the stock is still down some 33% year-to-date.

BMO Capital analyst Edward Sterck last month raised Vale’s stock rating to Buy from Hold, while lowering the price target to $9.50 from $12, citing the miner’s low-cost iron ore exposure offering a “relative safe-haven” for investors during the COVID-19 market volatility.

The analyst added that he sees the company’s Brazilian production more at risk of slowdowns than absolute shutdowns.

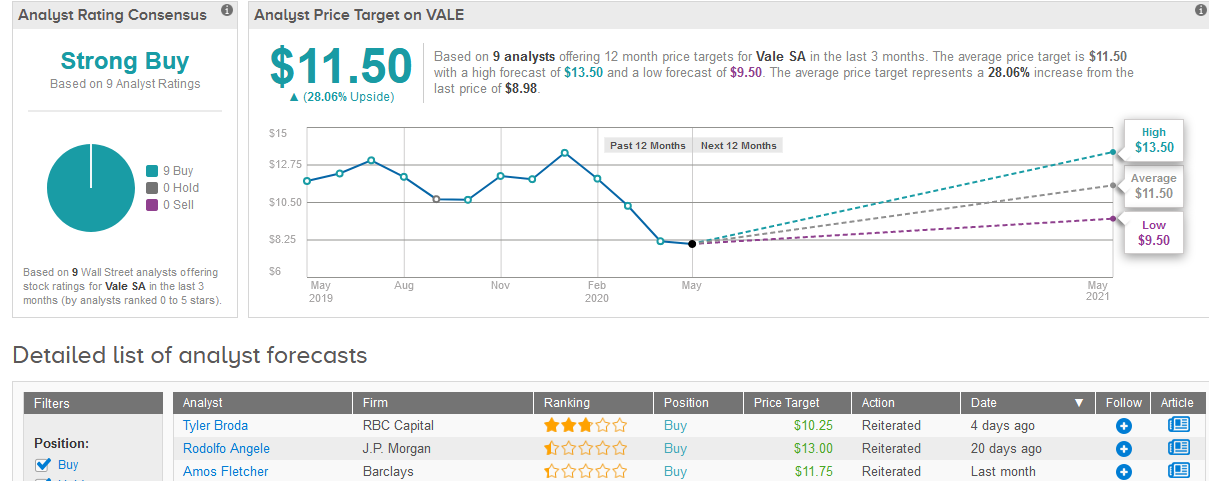

Turning now to the rest of Wall Street analysts, a bullish outlook prevails. Vale scores 9 Buy ratings adding up to a Strong Buy consensus. The $11.50 average price target indicates 28% upside potential in the shares in the next 12 months. (See Vale stock analysis on TipRanks).

Related News:

Regeneron To Repurchase $5 Billion Stake From Sanofi

Weight Watchers Fires Thousands Over Zoom

Facebook Workplace Hits 5 Million Paid Users As Remote Work Demand Rises