Apple (AAPL) has snapped up Canadian machine learning startup Inductiv Inc in its latest AI-related acquisition, Bloomberg reports. According to the report, Inductiv’s engineering team has joined Apple “in recent weeks” to work on several different projects including Siri, machine learning, and data science.

“Inductiv developed technology that uses artificial intelligence to automate the task of identifying and correcting errors in data. Having clean data is important for machine learning, a popular and powerful type of AI that helps software improve with less human intervention” Bloomberg writes.

Apple has issued its customary statement in response, saying that it “buys smaller technology companies from time to time and we generally do not discuss our purpose or plans.”

The iPhone maker has been on a buying spree this year, purchasing NextVR which provides content ranging from sports, music, and entertainment for virtual reality headsets, Voysis, an Irish startup that focuses on voice technology, and Dark Sky, a popular weather app.

Shares in Apple have rallied 8% year-to-date, and analysts have a bullish outlook on the stock’s prospects. After AAPL announced that it is re-opening 100 more stores across the US, three analysts boosted their Apple price targets.

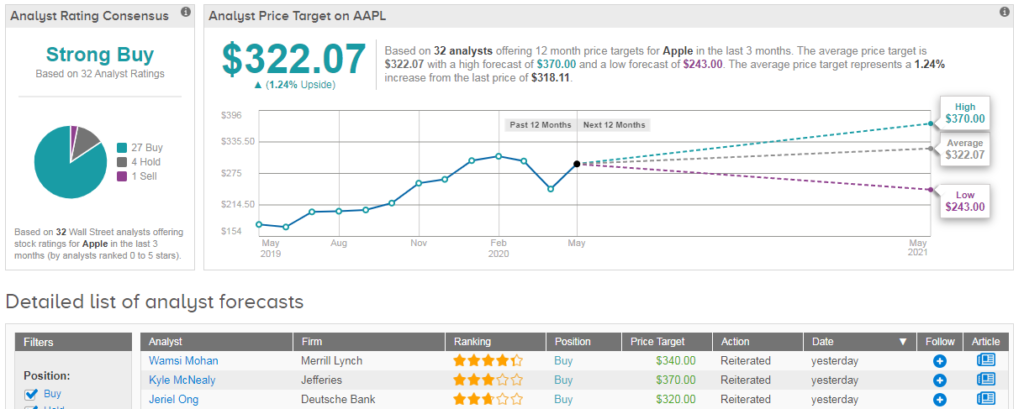

“We see store reopenings as a directional sign of improving trends and a drift toward a more normalized demand environment for Apple,” Deutsche Bank’s Jeriel Ong cheered, as he upped his price target from $305 to $320.

Meanwhile Jefferies analyst Kyle McNealy commented: “Our web-traffic analysis indicates that Apple has seen strong growth through online channels since the start of COVID-19.” He took his price target to a Street-high of $370 from $350, for upside potential of 16%.

Also on May 27, Bank of America’s Wamsi Mohan issued an AAPL price target of $340 from $320 previously, citing the iPhone’s large installed base.

Overall, out of 33 Wall Street analysts, a majority of 27 assign Buys, 4 have Holds and 1 has a Sell, giving AAPL a Strong Buy consensus. However the $322 average price target foresees a mere 1% upside potential in the coming 12 months. (See Apple stock analysis on TipRanks).

Related News:

Data Center Set to Send Nvidia Stock Soaring Even Higher

Google Faces Arizona Lawsuit Over ‘Unfair’ Location Data Storing

Microsoft Seeks $2B Stake In India’s Jio Platforms- Report