Shares in Amarin (AMRN) popped 4% in Thursday’s after hours trading after the company presented encouraging data on Vascepa (icosapent ethyl) in patients with prior PCI [percutaneous coronary intervention] at the virtual Transcatheter Cardiovascular Therapeutics (TCT) Connect conference.

The REDUCE-IT PCI analysis looked at 3,408 (41.7%) of patients enrolled in REDUCE-IT who had undergone a prior PCI.

Compared with placebo, Vascepa significantly reduced primary composite first and total MACE (major adverse cardiovascular events) in post hoc exploratory analyses of patients with a history of PCI by 34% and 39%, respectively, and key secondary composite first hard MACE, comprised of heart attacks, stroke and cardiovascular death, by 34%.

“The opportunity to further explore Reduce-It data and effects in those patients with prior PCI [percutaneous coronary intervention] provides additional understanding of the potential benefit of icosapent ethyl in the clinical setting,” commented Dr. Deepak L. Bhatt, the trial’s principal investigator.

“The statistically significant substantial benefit in reduced coronary revascularization procedures seen as early as 11 months provides clinicians with a potential additional intervention in a patient population for whom time is of the essence” he added.

Vascepa is comprised solely of the active ingredient, icosapent ethyl (IPE). It was launched in 2013 as an adjunct therapy to diet to reduce triglyceride levels in adults with severe hypertriglyceridemia- with a new, cardiovascular risk indication approved by the FDA in late 2019.

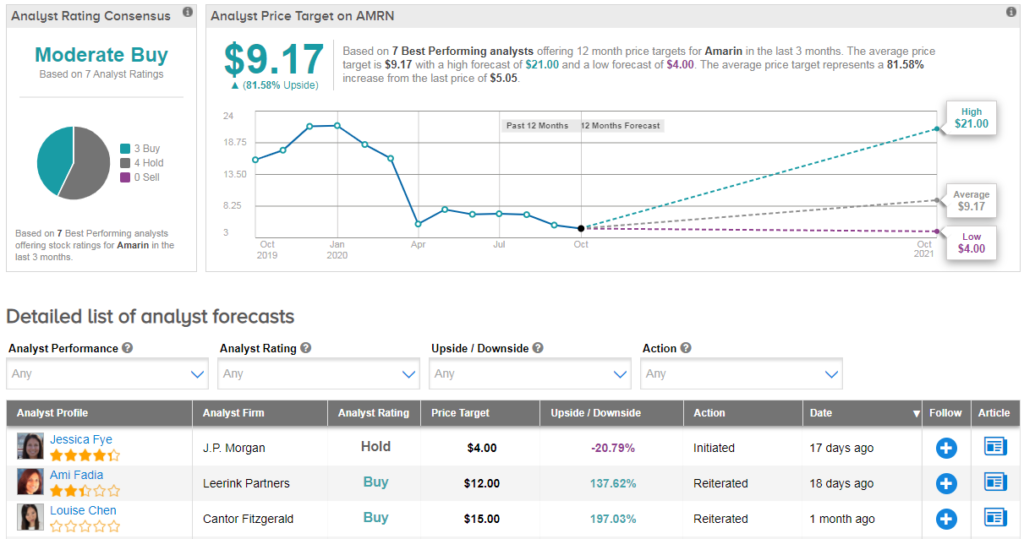

However, the stock has been plagued by generic drug makers like Hikma Pharmaceuticals and Dr. Reddy’s, who have their own plans for versions of Vascepa. As a result shares in Amarin have plunged 76% year-to-date, and the stock scores a cautiously optimistic Moderate Buy Street consensus. That’s with a $9 average analyst price target (81% upside potential).

However, Cantor analyst Louise Chen argues the game is far from over. Chen said, “We continue to think that AMRN’s EU opportunity is underappreciated and that generics companies will not be able to manufacture enough product to meet the demand in the U.S. market. We still believe that AMRN may generate strategic interest, possibly from an EU company with an established cardiovascular franchise.”

All in all, Chen rates AMRN Buy, although the “downward earnings estimate revisions for U.S. sales of Vascepa” result in a price target reduction from $35 to $15. (See AMRN stock analysis on TipRanks)

Related News:

Vertex Sinks 12% On Halt of VX-814 Development; Merrill Lynch Says Buy

J&J Halts Covid-19 Vaccine Trial Due To ‘Unexplained Illness’

Pfizer, BioNTech Initiate Rolling Canada Submission For Covid-19 Vaccine