Alteryx, Inc. (AYX) announced the acquisition of Lore IO, a non-code artificial intelligence (AI) enabled data modeling platform, for an undisclosed sum. The acquisition will provide Alteryx with the talent and knowledge to allow customers to analyze large datasets for actionable self-service insights. Shares closed down 2.7% at $72.77 on October 22.

Alteryx provides self-service data analytics software. The company enables smooth digital transformation with a combination of analytics, data science, and business process automation in a single platform. Silicon Valley-based Lore IO was founded by veterans of Walmart Labs. (See Insiders’ Hot Stocks on TipRanks)

Commenting on the deal, Mark Anderson, CEO of Alteryx, said, “Lore IO brings a talented and tenured team that has decades of combined experience building mission-critical, cloud and analytics applications to increase big data fluency that enables customers to rapidly deploy analytics… Integrating Lore IO’s technology and talent aligns with our ambitious innovation agenda to allow enterprises to unlock the value of their data, uncovering business insights no matter how complex their datasets are or where the data resides.”

Following the acquisition news, William Blair analyst Kamil Mielczarek maintained a Buy rating on the stock and said, “We expect continued M&A to supplement internal R&D efforts and accelerate Alteryx’s cloud transition… This acquisition furthers Alteryx’s efficiency in increasing big data fluency and enabling customers to deploy rapid analytics no matter where the data resides.”

Mielczarek added, “We expect Lore IO’s addition to help drive demand for Alteryx’s Designer Cloud, which is expected to launch in early 2022. We estimate Lore IO is generating revenue in the low-single-digit millions.”

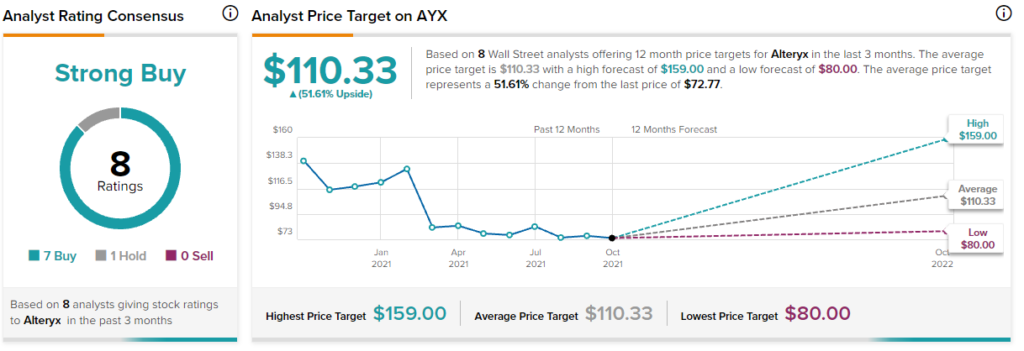

Overall, the stock commands a Strong Buy consensus rating based on 7 Buys and 1 Hold. The average Alteryx price target of $110.33 implies 51.6% upside potential to current levels. Shares have lost 47.1% over the past year.

Related News:

American Express Jumps 5.4% on Stellar Q3 Results

VFC Sinks 5% on Disappointing Q2 Results

Snap Plunges 22% After-Hours on Disappointing Q3 Results