Agnico Eagle Mines (AEM) posted better-than-expected first-quarter results. Strong operational performance in March drove record quarterly gold production.

Agnico Eagle’s revenue came in at $934.39 million for the quarter ended March 31, an increase of 39% from $671.88 million in the prior-year quarter.

Net income was $136.1 million ($0.56 per share) in 1Q 2021 compared to a loss of $21.6 million ($0.09 per share) in 1Q 2020. Meanwhile, adjusted net income was $162.9 million ($0.67 per share), compared to a net loss of $21.6 million ($0.09 per share) a year ago. The consensus estimate was for adjusted EPS of $0.60 on $1.25 billion in revenue.

Agnico Eagle’s CEO Sean Boyd said, “Building on the back of strong operating results in the second half of 2020, we are reporting our second consecutive quarter of record production, with strong operational and safety performance at all of our key mines and better than forecasted costs. The Company remains on track to hit its production and cost guidance for 2021, and we expect to generate strong free cash flow during the year.”

In addition, Agnico Eagle will release its 2020 Sustainability Report on April 30, 2021, highlighting the progress made over the past year in the areas of sustainability and responsible mining.

Agnico Eagle’s board of directors declared a dividend of $0.35 per share, payable June 15, 2021, to shareholders of record on June 1, 2021. (See Agnico Eagle Mines stock analysis on TipRanks.)

Following first-quarter results, Canaccord Genuity analyst Carey MacRury reiterated a Buy rating on the stock with a price target of $73.32 (C$90.00)(15.2% upside potential).

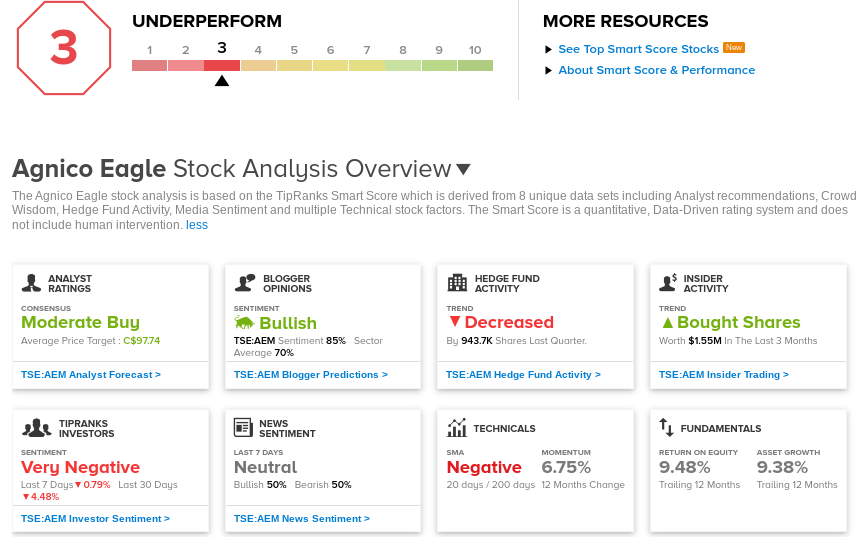

The rest of the Street is cautiously optimistic about AEM with a Moderate Buy consensus rating based on 8 Buys and 3 Holds. The average analyst price target of C$97.74 implies an upside potential of about 25% to current levels. Shares have plunged approximately 13% year-to-date.

AEM scores a 3 out of 10 on the TipRanks Smart Score rating system, indicating that the stock could underperform the overall market.

Related News:

Restaurant Brands Posts Better-Than-Expected Results In 1Q; Shares Up 3%

The Green Organic Dutchman Gives Update On Operations

Transat Gets C$700M Aid From Ottawa; Shares Jump 6%