Shares of ADMA Biologics (ADMA) jumped 30% in early trading on Wednesday after the commercial biopharmaceutical company announced that its expanded manufacturing process received US Food and Drug Administration (FDA) approval. The process is designed to enable fractionation and purification of a 4,400-liter plasma pool for the manufacture of Intravenous Immune Globulin (IVIG).

ADMA Biologics CEO Adam Grossman said, “The FDA approval of the 4,400-liter IVIG plasma pool production scale process is a transformative milestone for the ADMA organization and will allow the Company to produce significantly more IVIG for the U.S. market and for patients living with immune deficiencies.”

“The expanded plasma pool production scale allows us to confidently commit to generating peak revenues in excess of $300 million and this approval solidifies the pathway to meaningful gross margin expansion beginning potentially in the second half of 2021 and accelerating throughout 2022,” Grossman added. (See ADMA Biologics stock analysis on TipRanks)

Notably, ADMA’s 4,400-liter IVIG plasma pool scale for BIVIGAM will expand the total processing capacity from 400,000 liters to an expected 600,000 liters. The FDA approval means the company can now produce BIVIGAM at an expanded capacity while maintaining the same high level of quality. Furthermore, the same equipment, release testing assays, disposables, and labor force can also be used.

According to the company, significant gross margin improvement is expected as production throughput flows through the standard 7 to 12-month manufacturing cycle for plasma-derived therapies. Additionally, the approval permits ADMA to offer BIVIGAM in both the 50 ml and 100 ml configurations.

On April 23, Raymond James analyst Elliot Wilbur reiterated a Buy rating on the stock.

Wilbur commented, “ADMA reported 4Q20 results late last month, showing overall positive developments in the challenging plasma market space. The stability of the third-party supplier contract with Grifols remains a clear positive for the company, as inventory continues to grow at rates consistent with the revenue target of $250.0M by 2024. Rapid expansion of ADMA’s collection center portfolio remains a key focus as well, with management having stated that the plasma market supply constraints are not expected to impact the company at this time.”

Consensus among analysts is a Strong Buy based on 4 unanimous Buys. The average analyst price target stands at $8.50 and implies upside potential of approximately 255% to current levels.

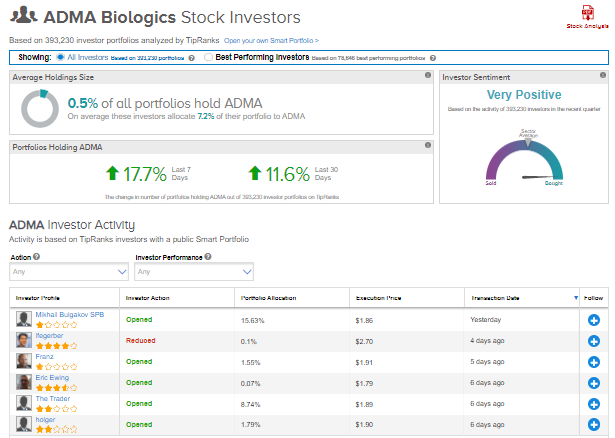

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on ADMA Biologics, with 17.7% of investors increasing their exposure to ADMA stock over the past seven days.

Related News:

Amazon’s AWS Partners With DISH Network

Salesforce Aids Sonos In Digital Transformation

Crocs Pops 11% After 1Q Results Beat Expectations