Accenture (ACN) has entered into an agreement to acquire Sentelis, a French independent data consulting and engineering company that specializes in designing and scaling data and artificial intelligence (AI) capabilities.

Sentelis and its 50-strong team will join Accenture Applied Intelligence and will help Accenture clients build the right data strategy and foundation to industrialize AI across their businesses, ACN says. This acquisition would strengthen Accenture’s growing analytics, AI and ML/data engineering business in France.

“Our research shows that a strong data foundation underpins an organization’s ability to successfully scale AI,” said Athina Kanioura, of Accenture Applied Intelligence. “Strategic acquisitions — like Sentelis — are bringing greater capacity and enhanced capabilities to our data and AI client work.”

Global growth in AI client engagements has also served as a driver for Accenture’s recent acquisitions of Analytics8 in Australia, Pragsis Bidoop in Spain, Clarity Insights in North America, Mudano in the UK and Byte Prophecy in India.

Financial terms of the transaction, which is subject to customary closing conditions, are not being disclosed.

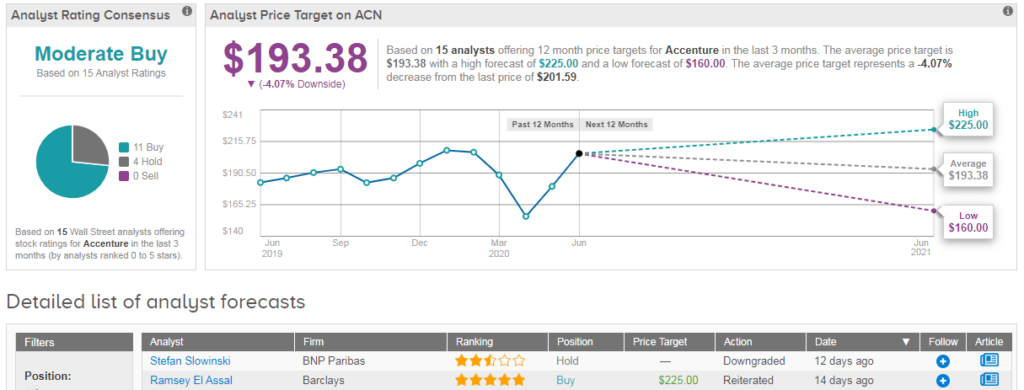

Shares in Accenture have climbed 21% in the last three months, and analysts have a cautiously optimistic Moderate Buy consensus on the stock’s outlook. However its $194 average price target indicates 4% downside potential from current levels. (See Accenture stock analysis on TipRanks).

RBC Capital’s Daniel Perlin has a buy rating on the stock and $207 price target. “We believe ACN is a core large-cap holding that has successfully transitioned its business to more relevant next- generation services” the analyst cheers.

According to Perlin, ACN is uniquely positioned to profit from: 1) its digital and cloud revenues having overtaken its legacy ERP revenues; 2) significant at-scale capabilities, spanning the entire spectrum of technology services, which he sees as a significant competitive advantage; and 3) has a demonstrated track record of shareholder-friendly capital redeployment.

Related News:

AT&T Mulls $4 Billion Sale Of Gaming Division- Report

Amazon Now Also Under Investigation By Washington State – Report

Match Group and Bumble Put To Bed All Litigation Claims