Nio has offered to sell an aggregate $1.3 billion in convertible senior notes as the Chinese electric vehicle company continues to tap financial markets.

According to the offering, Nio (NIO) will sell $650 million in aggregate principal amount of convertible senior notes due 2026 and $650 million in aggregate principal amount of convertible senior bonds due 2027. Furthermore, the company will grant the initial debt purchasers a 30-day option to buy up to an additional $100 million each in aggregate principal amount of the 2026 and 2027 notes.

“The company plans to use the net proceeds from the notes offering mainly for general corporate purposes and to further strengthen its cash and balance sheet positions,” Nio stated.

Holders can convert their notes at any time on or after August 1, 2025, in the case of the 2026 notes, or August 1, 2026, in the case of the 2027 notes. Following the pricing of the debt offering, Nio intends to enter into one or more separate and individually privately negotiated agreements with one or more holders of its outstanding 4.50% convertible senior notes due 2024 to exchange a portion of the debt for its American Depositary Shares (ADS).

The offering comes after Nio last month completed the sale of 68,000,000 ADSs each representing one Class A ordinary share of the company at a price of $39 per ADS. Shares rose 1.4% in Tuesday’s pre-market session after closing at $62.70 the day before. (See Nio stock analysis on TipRanks)

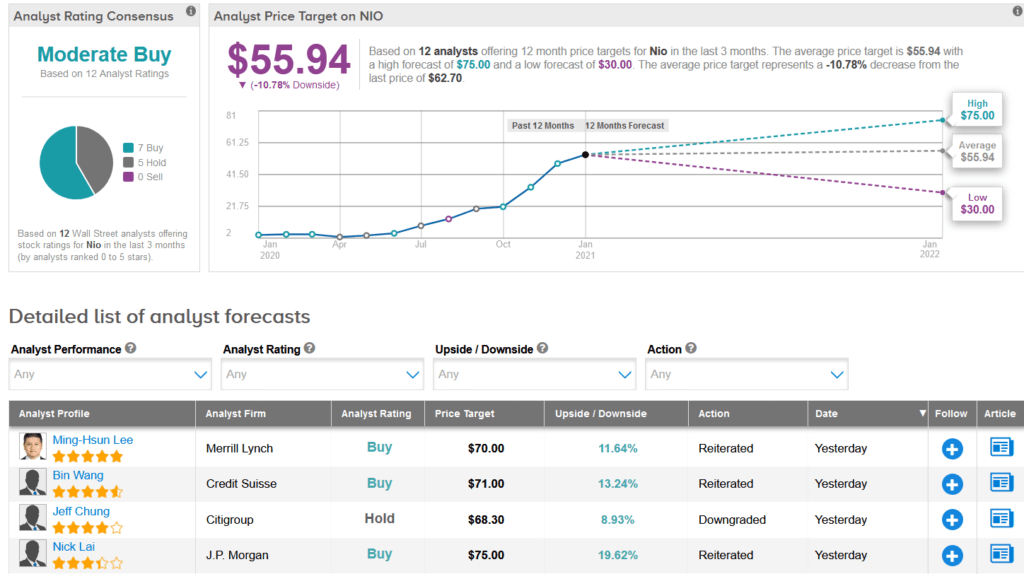

Looking at the past year, investors have been piling into the stock, pushing shares up a stellar 1,688%. Meanwhile, Nio still scores a Moderate Buy consensus from the analyst community. That’s with an average analyst price target of $55.94, which implies 11% downside potential over the coming 12 months.

The big event for Nio was its annual extravaganza on Jan. 9, where the EV maker disclosed its first sedan model, the ET7, and announced a collaboration with Nvidia Corp.

Following the event, Citigroup analyst Jeff Chung cut the stock’s rating to Hold from Buy, but lifted the price target to $68.30 from $46.40.

The ET7 is “good but not enough to make any critical changes from Tesla’s challenge,” Chung wrote in a note to investors. The analyst expects the ET7 to record limited incremental sales of 3,000 to 4,000 units per month starting in the first quarter of 2022.

Furthermore, he believes that the ET7 may face competition by a future upgrade of Tesla’s model S, while a Model Y price discount could create head-to-head competition with Nio’s EC6.

Related News:

Nio Teams Up With Nvidia For Electric Vehicle Push; Street Sees 15% Downside

Tesla Surges to Record Putting Musk Ahead Of Bezos As the World’s Richest Person – Report

Acuity Brands Drops 5.5% Despite 1Q Profit Beat; Oppenheimer Stays Bullish