Shares in Exelon are advancing 5.1% in Tuesday’s pre-market trading session following a report that the company is mulling a breakup that would involve the spinoff of its non-utility assets, including the divestment of its nuclear plants.

According to the Bloomberg report, Exelon (EXC) is working with advisers to evaluate the split. No final decision has been made and Exelon could opt to keep its current structure, they said.

“As we most recently communicated on our second quarter earnings call, we regularly review our corporate structure and overall mix of businesses to determine how to best create value and position our businesses for success,” William Gibbons, a representative for Exelon, said in a statement.

Exelon’s non-utility operations include 21 nuclear reactors as well several solar, wind and natural-gas generating assets, according to its website. A potential split would leave Exelon focused on the regulated power market, with a portfolio that includes a half-dozen utilities in Pennsylvania, Maryland, Delaware and elsewhere, according to the report.

Finding a buyer for Exelon Generation, the company’s non-utility arm, would be tough, and a spinoff to shareholders is a more likely result, said Kit Konolige, utilities analyst for Bloomberg Intelligence.

“Most utilities would note that Exelon hasn’t been able to prove that it’s a good thing to have a utility combined with merchant plants and a bunch of nuclear plants,” said Konolige. “There might not be that many interested buyers.”

Power companies are increasingly divesting unregulated assets to focus on their utilities, in part because investors prefer pure-play businesses. Earlier this year, Dominion Energy agreed to sell its natural gas infrastructure earlier this year to Berkshire Hathaway.

Activist investor Corvex Management said last week that Exelon could be worth roughly $60 a share, and that the company should separate its utility business to unlock that underlying value, Bloomberg reported.

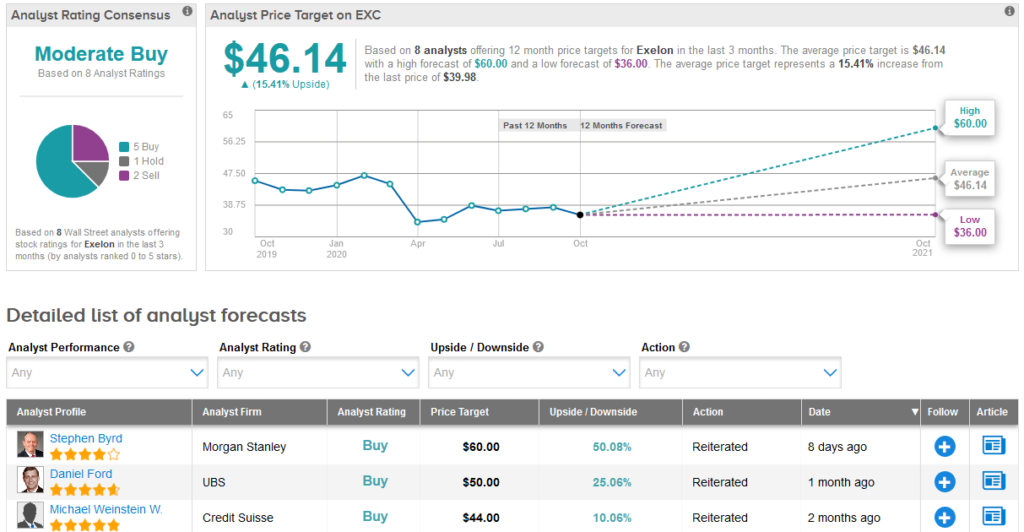

Exelon shares appreciated 10% over the past month but are still down 12% on a year-to-date basis. Looking ahead, $46.14 the average analyst price target implies 15% upside potential over the coming year.

Morgan Stanley analyst Stephen Byrd recently reiterated a Buy rating on the stock with a $60 price target (50% upside potential), saying that EXS is “risk-reward highly attractive” with the stock trading below the utility-only value.

“EXC offers above avg. utility earnings growth of 6-8% through 2022 and owns a large, highly contracted, unregulated merchant fleet that the market currently prices at zero value (vs. our ~$19/shr valuation),” Byrd wrote in a note to investors. “We believe the market underappreciates ExGen’s unlevered FCF generation of +$1.5b/yr., margin stability from contracted payments, and the the rerating that could result from potential carbon legislation in the US.”

“Despite concerns about the company’s balance sheet we see various tools at their disposal to defend the credit rating without the need to issue equity in the near term, including the retirement of uneconomic nuclear plants,” the analyst summed up.

Overall, Wall Street analysts are cautiously optimistic on the stock. The Moderate Buy analyst consensus shows 5 Buys versus 1 Hold and 2 Sells. (See Exelon stock analysis on TipRanks)

Related News:

PerkinElmer Raises 3Q Sales Outlook Fueled By COVID-19 Testing Demand

J&J Halts Covid-19 Vaccine Trial Due To ‘Unexplained Illness’

Pfizer, BioNTech Initiate Rolling Canada Submission For Covid-19 Vaccine