Investors know that the key to profits is in the return – and that means, a willingness to shoulder risk. Risk is relative, of course, and tends to run hand-in-hand with the return potential. Find a stock with a giant return potential, and chances are, you’ve also found one with a higher risk profile.

The highest returns usually come along with the lowest share prices. After all, when a stock is priced for just pennies, even a small gain in share price translates into a huge return. Which means that penny stocks – these days, usually seen as those equities priced under $5 – combine a perfect storm of market attractions: low share price, high return potential, and higher than usual risk.

Given the nature of these investments, Wall Street analysts recommend doing some due diligence before pulling the trigger, noting that not all penny stocks are bound for greatness.

With this in mind, we set out our own search for compelling investments that are set to boom. Using TipRanks’ database, we pulled two penny stocks that have amassed enough analyst support to earn a “Strong Buy” consensus rating. Adding to the good news, each pick boasts over 300% upside potential.

Kintara Therapeutics (KTRA)

We’ll start with Kintara Therapeutics. This clinical-stage biomedical firm is focused on developing new treatments for cancer patients – but for patients who have already failed at, or proven resistant to, existing therapeutic agents. The company has two drug candidates with multiple potential indications. Both candidates are well along the development pipeline, being ready for Phase 3 testing on at least one track.

The first of these projects is VAL-083, a first-in-class small molecule bifunctional alkylating agent. The drug candidate has already demonstrated the ability to cross the blood-brain barrier, and it has received Orphan Drug designation and Fast Track designation from the FDA for the treatment of glioblastoma multiforme, a dangerous brain cancer. Kintara published Phase 2 clinical trial results for VAL-083 in July and September of this year, results that affirmed both safety and efficacy of the drug in patients with two different glioblastoma subtypes. The company is continuing to evaluate this drug candidate in the GBM AGILE registrational study.

REM-001, the second development track, takes a different approach to cancer treatment. It is not just a drug, but a combined therapy, a second-gen photodynamic therapy photosensitizer agent used to combat dangerous, unresectable solid tumors. The REM-001 therapy involves a laser light source, a light delivery device, and the drug candidate REM-001. The drug is administered directly to the tumor, and activated using the laser light. Kintara is studying REM-001 as a treatment for cutaneous metastatic breast cancer (CMBC). The company is working on drug manufacture, to ensure a sufficient quantity to complete a 15-patient confirmatory study, and has plans to initiate a pivotal study next.

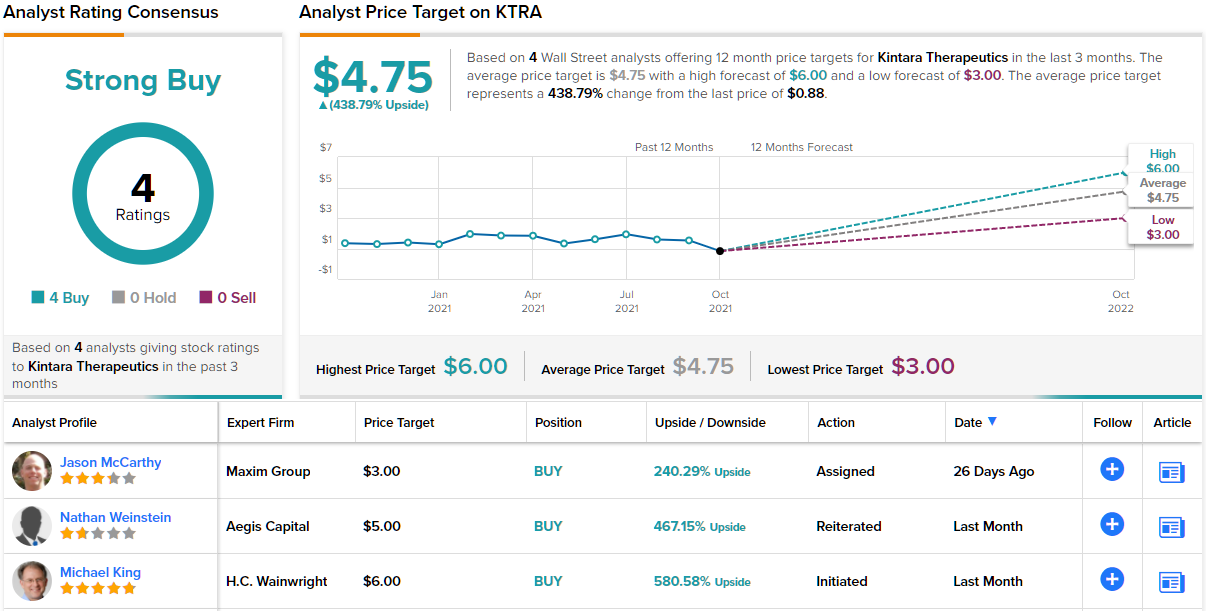

Thanks to its promising pipeline and $0.88 share price, 5-star analyst Michael King, of H.C. Wainwright, sees an attractive entry point for investors.

“We are bullish about KTRA shares for the following five reasons: (1) The GBM AGILE trial tests VAL-083 in all three subtypes of GBM, allowing for multiple opportunities for VAL-083 to prove its efficacy against phenotypically distinct types of the disease. (2) VAL-083 is a bifunctional alkylating agent that crosses the blood brain barrier and exhibits very favorable pharmacologic properties relative TMZ; fulfilling the need for systemic availability in the brain. (3) VAL-083 has an established favorable safety record, both from initial trials and prior clinical use in multiple indications. (4) Dire unmet need in GBM may present relatively low bar for approval. (5) Phase 3 ready REM-001 is an additional bonus which is not factored into our valuation assumptions and could potentially deliver value to shareholders while providing a backstop against downside,” King explained.

To this end, King rates KTRA a Buy along with a $6 price target. Should his thesis play out, a potential twelve-month gain of 580% could be in the cards. (To watch King’s track record, click here)

Overall, Kintara has impressed its observers, as shown by the unanimous Strong Buy consensus rating on the shares, based on 4 recent Buy reviews. With a return potential of 438%, the stock’s consensus price target stands at $4.75. (See KTRA stock analysis on TipRanks)

DiaMedica Therapeutics (DMAC)

The second company we’re looking at is DiaMedica, a clinical-stage biopharma company engaged in developing innovative treatments for neurological and kidney diseases with significant unmet medical needs. The company’s initial work is on a pharmaceutically active recombinant KLK1 protein, which is used in the treatment of acute ischemic stroke (AIS) and chronic kidney disease (CKD).

DiaMedica has one leading drug candidate, currently undergoing two clinical trials. In the first, DM199 is undergoing a Phase 2/3 study in the treatment of AIS, the REMEDY study. The drug is used to promote microcirculation when administered up to 24 hours post onset of stroke symptoms. This is a longer window than with existing stroke therapies. The REMEDY study was initiated in the summer of this year, and has 350 patients. The FDA has granted Fast Track designation to DM199 for this indication.

On the ‘kidney track,’ DM199 has a unique application – the treatment of CKD in African Americans. This population has a 3x to 4x higher risk of developing severe kidney disease than Caucasians, and existing therapies bring serious side effects, including development of excess potassium levels in the heart. DM199 is expected to avoid these problems, while its nature as a protein replacement therapy may directly address the underlying causes of kidney disease to restore function and prevent further damage.

In June of this year, DiaMedica released interim data on the Phase 2 REDUX study, which includes 20 African American among the 75 enrolled patients. The data showed clinically significant results, as well as positive drug toleration and no adverse effects.

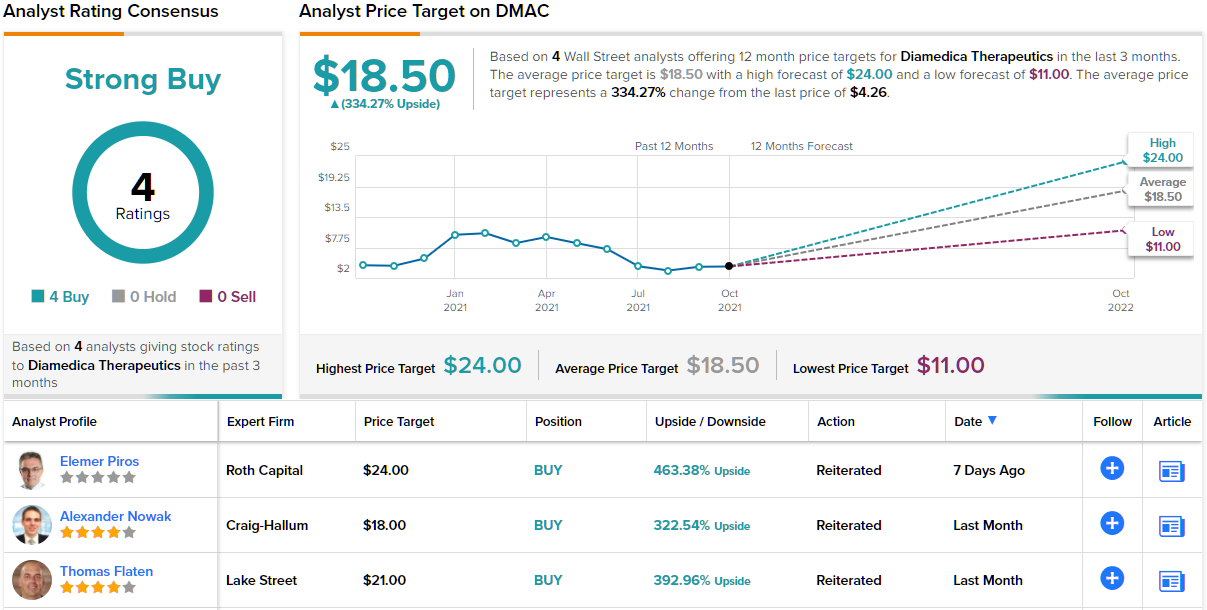

Turning to the analyst community, Craig-Hallum analyst Alexander Nowak is especially bullish on the AIS track in DiaMedica’s pipeline.

“With Fast Track designation in hand, we again argue stroke is the more exciting element of the story. The reasons are compelling phase 2 data, very limited competition, clean market/patient inclusion criteria and potential for add-on indications such as stroke recurrence. Yet with the stock trading at a $100M market cap, the market continues to neglect the high-potential opportunity. With the capital overhang lifted, pivotal underway and Fast Track in-hand, we expect the stock to act stronger through year-end. An added option would be out-licensing the kidney program to an ex-U.S. partner for non-dilutive capital, external validation and potential expansion of stroke’s pivotal study OUS too,” Nowak opined.

In line with these comments, Nowak gives DMAC a Buy rating along with an $18 price target that indicates potential for 322% upside in the coming year. (To watch Nowak’s track record, click here)

All in all, DiaMedica has a Strong Buy consensus rating based on 4 unanimously positive analyst reviews. This stock is selling for $4.23 per share, and its $18.50 average price target implies it has room for 334% growth over the next 12 months. (See DMAC stock analysis on TipRanks)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.