Volatility in the stock market is expected to rise amid increasing coronavirus cases across the world. Among the uncertainty, TipRanks brings you the latest analyst action on some of your favorite stocks to help you deal with the volatility in the market. Let’s look into the top bullish and bearish calls of the day and see what the analysts have recommended.

Upgrades

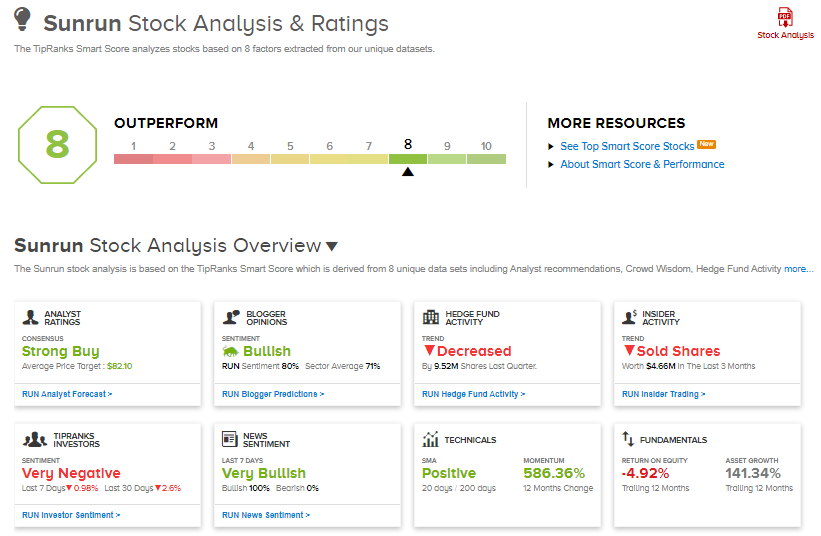

Goldman Sachs analyst Brian K. Lee upgraded Sunrun (RUN) to Buy from Hold and maintained a price target of $77 on the stock. Lee believes that the recent sell-off in RUN makes it appealing at current price levels. Furthermore, he views the risks associated with interest rates to be “overstated.”

On TipRanks’ Smart Score ranking, Sunrun gets an 8 out of 10, suggesting that the stock is likely to outperform market expectations.

Citigroup analyst William Katz upgraded Apollo Global Management (APO) to Buy from Hold and lifted the price target to $56 from $53, following CEO Leon Black’s exit announcement. Katz termed the move as a “favorable” development.

On TipRanks’ Smart Score ranking, Apollo gets a 9 out of 10, suggesting that the stock is likely to outperform market expectations.

Evercore ISI analyst Greg Melich upgraded Floor & Decor Holdings (FND) to Buy from Hold. The analyst sees Floor & Decor as “a nesting winner” and expects it to benefit significantly from the increase in ticket size and the reopening of the economy. Furthermore, Melich expects FND to gain market share while it cycles through easier year-over-year comps.

Meanwhile, the Street has a bullish outlook on the stock with a Strong Buy consensus rating based on 9 Buys and 1 Hold. The average analyst price target of $112.67 implies upside potential of about 14% to current levels.

Barclays analyst Lauren Lieberman upgraded PepsiCo (PEP) to Buy from Hold and maintained a price target of $151. Lieberman said that she is “perplexed” by its underperformance in 2021 compared to its peers in the staples industry and sees acceleration in its sales and profitability. The analyst remains upbeat on Pepsi’s prospects and sees it as a multi-year growth story.

Furthermore, TipRanks data shows that financial blogger opinions are 97% Bullish, compared to a sector average of 69%.

Merrill Lynch analyst Alexander Perry upgraded Columbia Sportswear (COLM) to Buy from Hold and maintained a price target of $128 on the stock. Perry expects COLM to recover fast in FY21 following strong sales in the first two months of this year. Furthermore, the analyst sees strong momentum in its DTC business.

TipRanks data shows that financial blogger opinions are 85% Bullish, compared to a sector average of 69%.

Downgrades

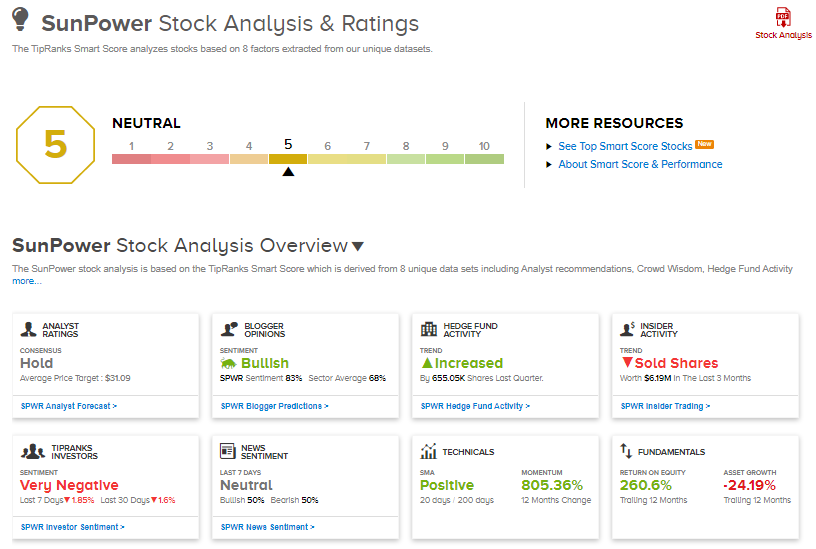

Goldman Sachs analyst Brian K. Lee downgraded SunPower (SPWR) to Hold from Buy and lowered the price target to $32 from $42 due to the recent run in its stock. Lee believes that the upside in SPWR remains capped while risk-reward remains balanced at current price levels.

On TipRanks’ Smart Score ranking, SunPower gets a 5 out of 10, suggesting that the stock is likely to perform in-line with the market expectations.

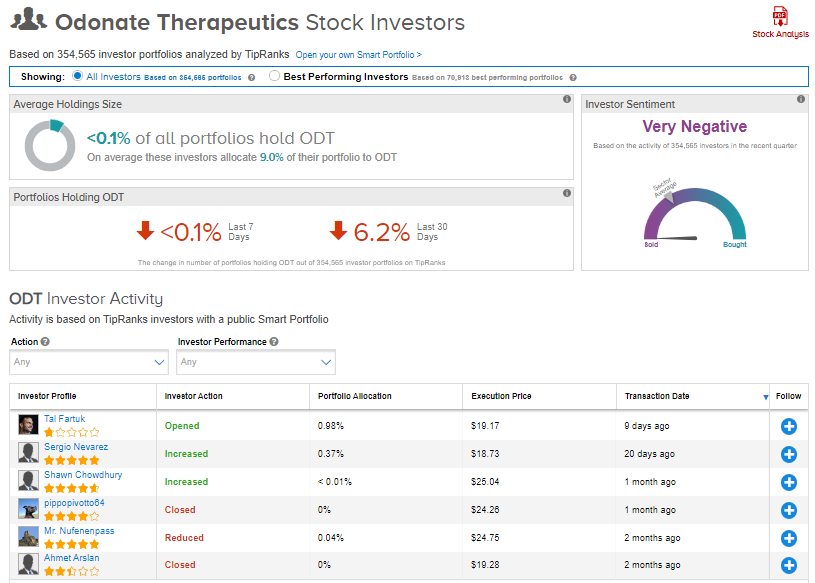

Cowen & Co. analyst Marc Frahm downgraded Odonate Therapeutics (ODT) from Buy to Hold after the it announced the discontinuation of the development of tesetaxel following a pre-NDA [New Drug Application] meeting with the FDA [Food and Drug Administration].

TipRanks’ Stock Investors tool shows that investors currently have a Very Negative stance on ODT, with 6.2% of investors reducing their exposure to ODT stock in the last 30 days.

Gabelli analyst Kevin Kedra lowered Elanco Animal Health’s (ELAN) rating to Hold from Buy. Kedra sees increased headline risk after the company had to temporarily recall the Seresto flea collar products from the market. The analyst maintained a price target of $32 on the stock but reduced his estimates to reflect a “modest negative” impact on the brand.

Overall, the Street has a cautiously optimistic outlook on the stock with a Moderate Buy consensus rating based on 3 Buys, 2 Holds and 1 Sell. The average analyst price target of $33.80 implies upside potential of about 13.5% to current levels.

Evercore ISI analyst Steve Sakwa downgraded Brandywine Realty (BDN) to Hold from Buy after the stock “massively outperformed” its peers following the release of its 4Q results on Feb. 2. Furthermore, Sakwa believes that the company lacks near-term growth drivers that could expand his valuation multiples.

TipRanks data shows that financial blogger opinions are 66% Bullish, compared to a sector average of 70%.

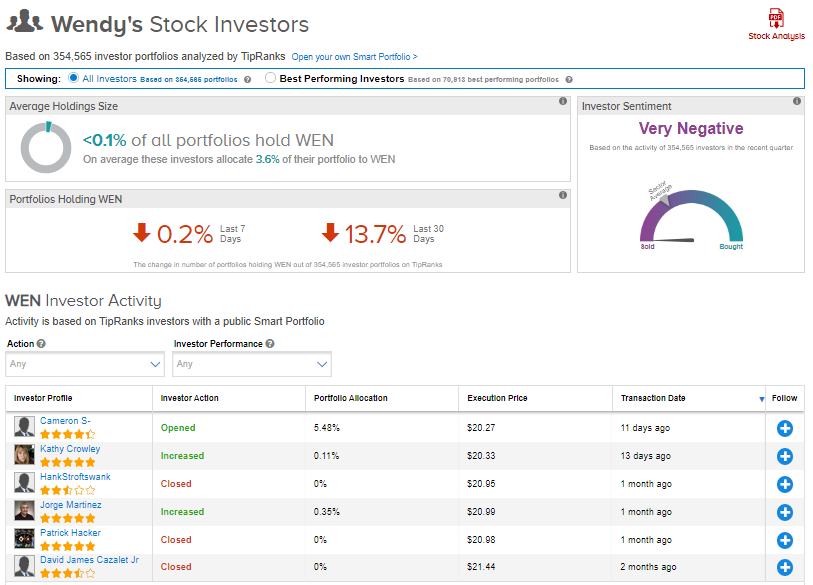

Argus Research analyst John Staszak downgraded Wendy’s (WEN) to Hold from Buy. The analyst expects the traffic to remain weak in the near term, while he views WEN to be fully priced at the current levels. Furthermore, Staszak notes that its debt to capitalization ratio remains high.

TipRanks’ Stock Investors tool shows that investors currently have a Very Negative stance on WEN, with 13.7% of investors reducing their exposure to WEN stock in the last 30 days.

Besides the above, you can also have a look at the following:

Should Investors Be Wary of Tesla Amid China Military Ban? Analyst Weighs In

AI Is Booming: 2 ‘Strong Buy’ Stocks That Stand to Benefit

Keep on Buying Alibaba Stock, Says Analyst Following Investor Meeting