With a resurgent virus in the background, the stock market continues to remain volatile. TipRanks brings you the latest analyst action on some of your favorite stocks to sail smoothly through the market volatility. Let’s look into the noteworthy bullish and bearish calls of the day and see what the top Wall Street analysts are recommending.

Upgrades

1. Hut 8 Mining Corp

Stifel Nicolaus analyst Deepak Kaushal upgraded Hut 8 Mining (HUTMF) to Buy from Hold and maintained a price target of C$9 following the company’s power purchase agreement with Validus Power. According to Kaushal, through the deal, Hut 8 Mining can decrease power costs by 40%. Furthermore, the power purchase pact indicates further capacity expansion and upside in valuation.

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Hut 8 Mining, with 9.8% of investors increasing their exposure to HUTMF stock over the past 30 days.

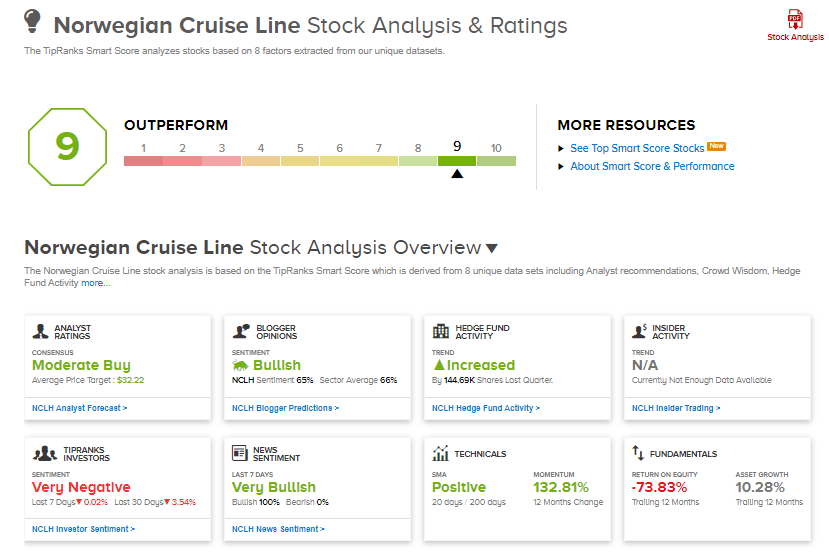

2. Norwegian Cruise Line

Goldman Sachs analyst Stephen Grambling upgraded Norwegian Cruise Line (NCLH) to Buy from Hold and increased the price target to $37 from $27. Grambling cited the company’s “industry leading” capacity growth, more aspirational consumers, and the longest liquidity runway with minimal leverage on fully recovered EBITDA, as reasons for the upgrade. Furthermore, the analyst believes that the company will be able to adjust to CDC guidelines and/or begin “vaccine only” voyages given its smaller fleet size, focus on North American clients, and limited passengers under 16 years of age.

Norwegian Cruise Line scores a 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

3. Dave & Buster’s Entertainment

William Blair analyst Sharon Zackfia upgraded Dave & Buster’s (PLAY) to Buy from Hold following the company’s improving sales data, which reflects a 38% year-over-year decline in the first 11 weeks of 1Q compared to a 47% plunge through the first eight weeks of the quarter. According to Zackfia, more open and fully operational locations led to the “dramatic recovery in sales trends”. Furthermore, the analyst has increased her sales and earnings estimates for 2021 and 2022 as she believes consensus estimates are too conservative.

Despite the upgrade, TipRanks data shows that financial blogger opinions are 55% Neutral on PLAY, compared to a sector average of 66%.

4. Western Areas Limited

Canaccord Genuity analyst Timothy Hoff upgraded Western Areas (WNARF) to Buy from Hold but decreased the price target to A$2.60 from A$2.90. In a note to investors, Hoff said that long term investors wanting exposure to nickel production may find value in the stock following the “material derate” in the stock price.

The consensus rating among analysts is a Strong Buy based on 4 Buys and 1 Hold. The average analyst price target stands at $1.92 and implies upside potential of 8.8% to current levels.

5. Halma PLC

UBS analyst Xingzhou Lu upgraded Halma (HLMAF) to Buy from Hold and increased the price target to 2,900 GBP from 2,550 GBP. Lu expects the company’s organic and inorganic growth to accelerate in fiscal 2022 with a “value rotation reversal” expected to provide an “additional tailwind”.

Halma scores a 9 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Downgrades

1. PRA Health Sciences

Robert W. Baird analyst Eric Coldwell downgraded PRA Health (PRAH) to Hold from Buy and maintained a price target of $165 reflecting the pending acquisition by Icon.

According to TipRanks’ Smart Score system, PRA Health gets a 6 out of 10, which indicates that the stock is likely to perform in line with market averages.

2. PPD

Jefferies analyst David Windley downgraded PPD (PPD) to Hold from Buy but increased the price target to $47.50 from $43 following the announcement that Thermo Fisher will acquire PPD for $47.50 per share in cash.

TipRanks’ Stock Investors tool shows that investors currently have a Very Negative stance on PPD, with 6.4% of investors decreasing their exposure to PPD stock over the past 30 days.

3. Southern Copper Corp

UBS analyst Andreas Bokkenheuser downgraded Southern Copper (SCCO) to Sell from Hold on an expected decline in copper prices, lower production, and elevated costs. According to Bokkenheuser, with continued economic recovery in China, construction stimulus has been tightened by the government, which negatively impacted materials in the past. Furthermore, the analyst noted the declining demand for China copper together with the weakening of temporary price support factors. The analyst increased the price target to $65 from $60.

The Wall Street community is bearish about the stock with a Moderate Sell consensus rating. That’s based on 1 Hold and 3 Sells. The average analyst price target of $63.75 implies 10.7% downside potential to current levels.

4. J2 Global Inc.

Piper Sandler analyst James Fish downgraded J2 Global (JCOM) to Hold from Buy but increased the price target to $139 from $122 following the company’s plan to spinoff its eFax business. According to Fish, the spinoff can create “a sustainably higher multiple” for the remaining J2 business, but the spinoff catalyst is already priced in the stock. Furthermore, the analyst believes that go-to-market and operating expense perspectives do not favor the decision, and expects larger M&A to be limited after the spinoff, based on leverage.

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in J2 Global is currently Neutral, as 5 hedge funds decreased their cumulative holdings of the stock by 195,000 shares in the last quarter.

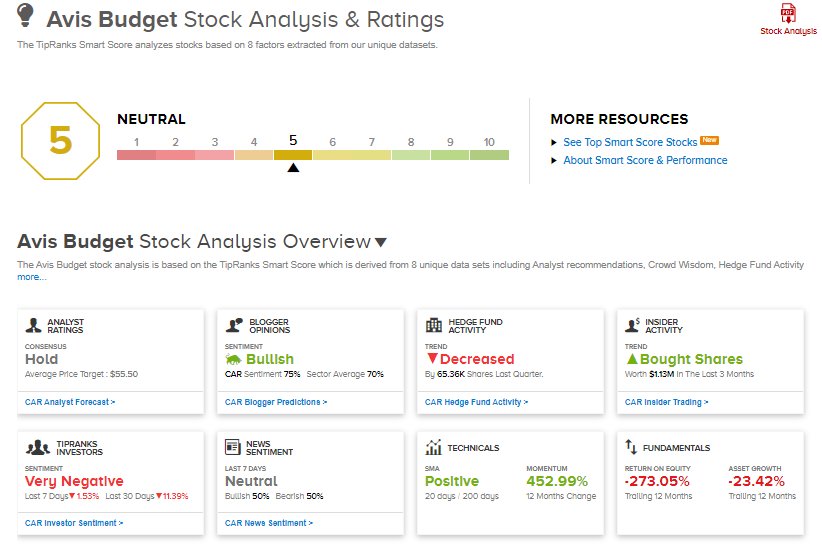

5. Avis Budget

Merrill Lynch analyst John Murphy downgraded Avis Budget (CAR) to Hold from Buy based on the company’s valuation. Murphy has updated his estimates for US auto sales and North American auto production. The analyst foresees year-over-year growth for US auto sales in 2021 but lowered estimates for 2022. Meanwhile, he expects lower North American production on a year-over-year basis in 2021 but increased forecasts for 2022.

According to TipRanks’ Smart Score system, Avis Budget gets a 5 out of 10, which indicates that the stock is likely to perform in line with market averages.

Besides the above, you can also have a look at the following:

The Recent Pullback in These 3 Stocks Is a ‘Buying Opportunity,’ Say Analysts

Has Plug Power Stock Reached an Attractive Entry Point? Analyst Weighs In

Goldman Sachs: These 2 Stocks Are Poised to Double (or More)

Dividend-Yield Calculator