Visa Inc.’s 4Q revenues fell 17% to $5.1 billion year-over-year dragged down by the decline in cross-border volumes due to the COVID-19 pandemic. However, revenues of the global payments technology company came ahead of analysts’ estimates of $5 billion.

Visa’s (V) total cross-border payment volume plunged 29% year-over-year on a constant currency basis. The company’s prior-quarter payments volumes, on which 4Q service revenue is recognized, fell 10% on constant currency. Total processed transactions increased by 3% year-over-year.

The company’s 4Q adjusted EPS decreased by 23% to $1.12 year-on-year but surpassed the Street consensus of $1.10. (See V stock analysis on TipRanks).

Visa CEO Alfred F. Kelly, Jr. said, “While our business drivers and financial results were impacted by COVID-19 in 2020, we’ve made significant progress in advancing our growth strategy.” He further noted, “As the world turns increasingly to digital payments, we see tremendous opportunity for growth. We’ll remain thoughtful in our investments as we advance our strategy to enable the movement of money for everyone, everywhere.”

Visa did not provide an outlook for fiscal 2021 citing continued global economic uncertainty due to the COVID-19 pandemic.

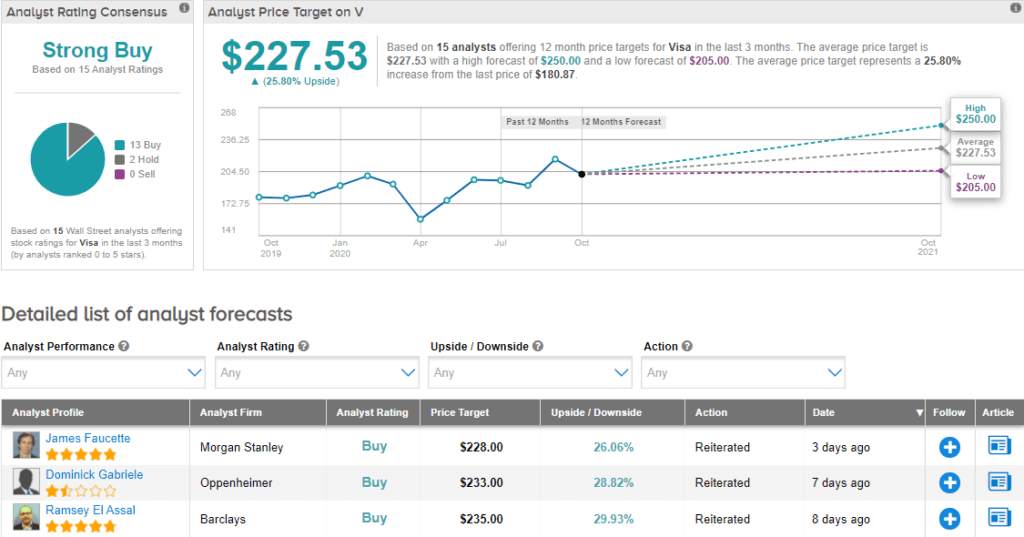

Following the earnings release, Mizuho Securities analyst Dan Dolev reiterated a Buy rating and a price target of $250 (31.5% upside potential). In a note to investors, Dolev wrote, “Our work points to accelerating card penetration and a boost to US volume growth. We believe the long-term stability and V’s best-in-class terminal margins (along with MA [Mastercard]) should merit a mid-teens revenue multiple.”

Currently, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 13 Buys and 2 Holds. With shares down nearly 4% year-to-date, the average price target of $227.53 implies upside potential of about 25.8% to current levels.

Related News:

Fiverr Surges In Pre-Market On Earnings, Revenue Beat

Microsoft Down After-Hours Despite Very Strong Earnings Beat

Shopify Inks Social Commerce Partnership With TikTok