Shares of ViacomCBS dropped 6.4% on Friday, as third-quarter sales and earnings dropped. The mass media conglomerate continues to face pressure across its multiple businesses due to the COVID-19 pandemic.

ViacomCBS’s (VIAC)’s 3Q sales fell 9% to $6.12 billion year-on-year while the adjusted EPS tanked 17% to $0.91. However, the company’s overall 3Q revenues and adjusted earnings beat Street estimates of $5.96 billion and $0.80 per share, respectively.

The company’s advertising revenues fell 6% year-over-year due to lower advertising demand amid the pandemic. Sales at Content Licensing dropped 33% reflecting adverse impacts of COVID-19 and timing of program availability. Theatrical revenues plunged 94% due to closure and capacity reductions at theaters amid the pandemic.

ViacomCBS’s Affiliate and Publishing segments’ revenues recorded an improvement of 10% and 29%, respectively, on a year-over-year basis. (See VIAC stock analysis on TipRanks).

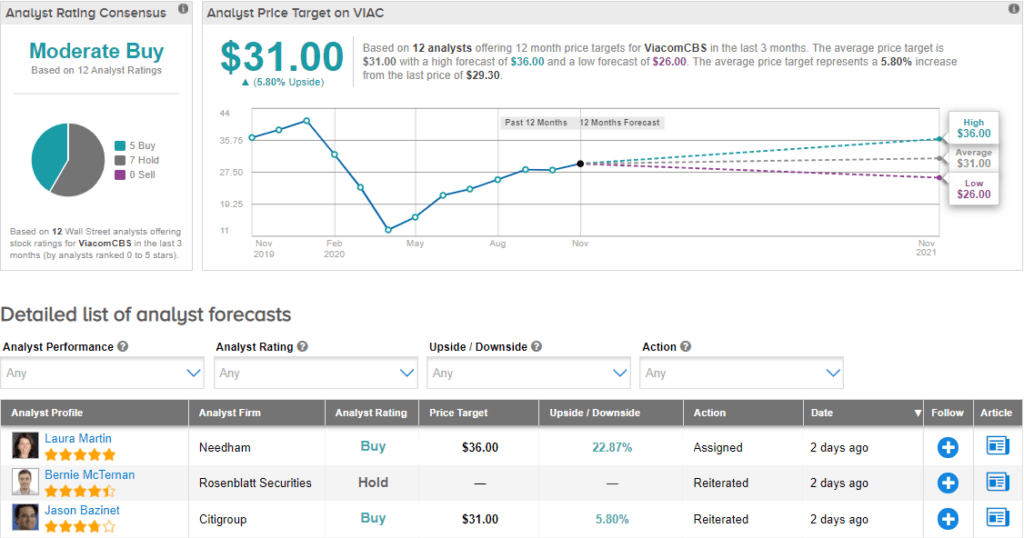

Following the earnings release, Needham analyst Laura Martin reiterated a Buy rating and a price target of $36 (22.9% upside potential). In a note to investors, Martin wrote, “We recommend purchase of VIAC because we believe that the value of its streaming assets are material and growing, and largely hidden until VIAC breaks streaming revenue out separately.”

The company, on Oct. 22, declared a quarterly cash dividend of $0.24, which translates into an annualized dividend yield of 3.28%, based on Friday’s closing price of $29.30.

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 5 Buys and 7 Holds. With shares down over 29% year-to-date, the average price target of $31 implies upside potential of about 5.8% to current levels.

Related News:

Yelp Pops 11% On Earnings Beat; RBC Upgrades To Buy

Electronic Arts Skids 7% On Weak Outlook, Declares First-Ever Dividend

Roku Surges 11% On Blowout Quarter; Street Bullish On Outlook