Automotive technology supplier Veoneer has inked an agreement with chipmaker Qualcomm Technologies to jointly develop software technology for its advanced driver assistance systems (ADAS).

The agreement comes after the two companies announced the intent for forming a partnership on Aug. 27, 2020. As part of the collaboration, Veoneer (VNE) and Qualcomm will create a software and chip platform for ADAS and autonomous driving solutions.

For the purpose of the partnership, Veoneer has created Arriver, a software unit dedicated for the development of the complete perception and drive policy software stack. Arriver, which will be 100% owned by Veoneer, will be integrated with Qualcomm’s (QCOM) Snapdragon Ride portfolio of System on a Chip (SoC) hardware.

“Today’s agreement with Qualcomm Technologies and the creation of Arriver are key milestones in Veoneer’s development. We will now move ahead with full force to create a market leading ADAS solution based on Arriver software and Qualcomm Snapdragon Ride SoC hardware,” said Veoneer CEO Jan Carlson. “Veoneer will now also be able to take the next steps as a next generation Tier-1 supplier offering the latest active safety and restraint controls electronics products to the market.”

Veoneer and Qualcomm said they also made progress on roadmap feature implementations. Additionally, the two companies announced that the Arriver software is already functional on the Snapdragon Ride platform and is expected to be available for automotive customers in coming months.

That’s after Veoneer presented the collaboration with Qualcomm to a number of vehicle makers and Tier-1 automotive suppliers and received “very positive feedback” on the specifications and capabilities of the platform.

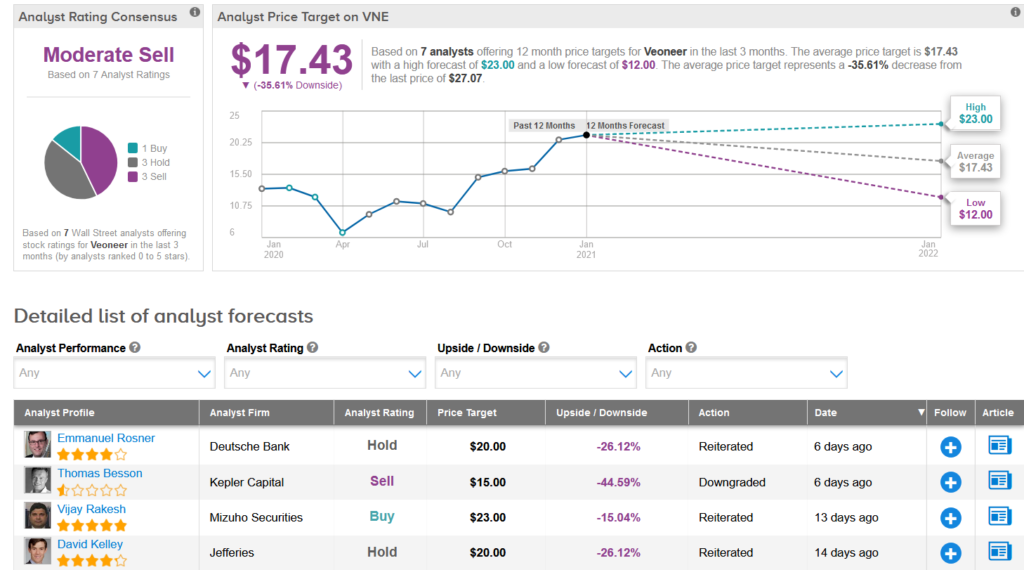

Veoneer shares have been on a stellar run, popping almost 100% over the past year. Looking ahead, the average analyst price target stands at $17.42, suggesting that the stock could pull back 36% over the coming 12 months.

In a bullish note, Mizuho analyst Vijay Rakesh this month reiterated the only Buy rating on the stock with a Street-high price target of $23 as he believes that the collaboration with Qualcomm will serve as a key driver for VNE growth.

“We see VNE well positioned with a LVP [light vehicle production] rebound in 2021 and ADAS with its QCOM partnership setting up well for long-term growth,” Rakesh wrote in a note to investors. “VNE is uniquely positioned to benefit from and also help drive auto-grade qualification across regulatory geographies for future LiDAR products to reach the mass market.”

In view of the stock’s sharp rally, the rest of the Street is cautiously bearish on the stock with a Moderate Sell analyst consensus. That’s based on 3 Sells, 3 Holds and Rakesh’s Buy rating. (See VNE stock analysis on TipRanks)

Related News:

NCR To Snap Up Cardtronics For $2.5B; Street Says Buy

AMC Secures $917M Lifeline To Avert Bankruptcy; Shares Pop 26%

Kimberly-Clark Tops 4Q Estimates, Hikes Dividend By 6.5%