Shares of UnitedHealth Group (UNH) gained 2.1% in Thursday’s pre-market trading session after reporting better-than-expected results for the third quarter of 2021. The company offers healthcare coverage and benefits services through UnitedHealthcare and information and technology-enabled health services through Optum.

UnitedHealth’s adjusted earnings of $4.52 per share came in ahead of Street expectations of $4.40. The figure also compared favorably with the $3.51 per share reported in the year-ago quarter. (See UnitedHealth stock charts on TipRanks)

Revenue in Q3 climbed 11.1% year-over-year to $72.3 billion. Furthermore, it surpassed analyst expectations of $71.1 billion. The company received premiums (about 79% of total revenue) worth $57 billion during the quarter, up 12% from the same period last year.

UnitedHealth served about 790,000 people in Q3, led by continued strong growth in Medicare Advantage, Dual Special Needs Plans, and Medicaid. Meanwhile, OptumHealth was able to expand its customer base by a million to 99 million people.

Following the strong quarter, UnitedHealth raised its full-year 2021 net earnings guidance to $17.70 – $17.95 per share from prior expectations of $17.35 to $17.85. Additionally, adjusted earnings are expected to be between $18.65 and $18.90 per share, compared with $18.30 to $18.80 previously guided. (See Top Smart Score Stocks on TipRanks)

On September 27, Leerink Partners analyst Jim Kelly initiated coverage of UnitedHealth with a Buy rating and a price target of $480. The price target implies upside potential of 18.9% from current levels.

Kelly said, “We see accelerating themes into 2022 likely to push the multiple up for a diverse and attractive global growth platform. Alongside UNH’s unparalleled breadth of care delivery capabilities at scale, we view UNH as an interesting way to invest into the long-term secular growth of US medical spending.”

The rest of the Street is optimistic about the stock with a Strong Buy consensus rating based on 15 Buys and 1 Hold. The average UnitedHealth price target of $467.63 implies 15.9% upside potential to current levels.

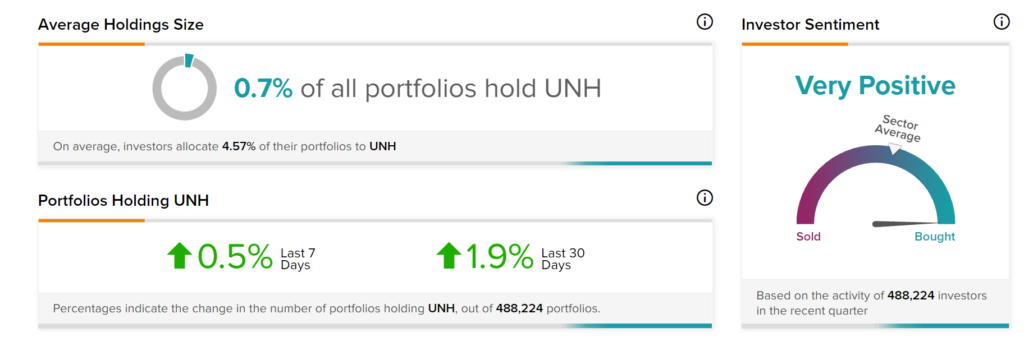

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on UnitedHealth, with 1.9% of investors increasing their exposure to UNH stock over the past 30 days.

Related News:

Winnebago Plans $200M Share Buyback Program; Shares Pop

E2open Delivers Mixed Q2 Results; Shares Drop

JPMorgan Q3 Results Beat Expectations