United Airlines Holdings Inc. (UAL) has communicated to two regional airlines, ExpressJet (XJT) and CommutAir, that it will continue to work with only one of them.

In a report from Reuters on July 28, a pilot union letter revealed United’s intentions, which would potentially result in a significant revenue loss for the unchosen carrier. ExpressJet and CommutAir work exclusively for United Airlines.

Before the pandemic, United Airlines expanded its domestic network by making agreements with regional airlines, which offered cheaper terms. However, with reduced travel due to COVID-19, United has been forced to scale its plans and reduce its workforce. This follows a trend of most airlines also decreasing scheduled flights for the rest of summer and fall in an attempt to retain cash.

In an email to Reuters, United said, “We’ve been clear for months now that we expect to be a smaller airline in response to the historic impact that the COVID-19 pandemic has had on our business. That means we’ve cut our schedules and our costs across the operation – and we do anticipate it will continue to impact the relationships we have with our regional partners.”

After United communicated that it would only require one E145 carrier in the future, ExpressJet Union chairman wrote a letter to its pilots, saying that there would be a “dramatic impact” on the airline’s future.

The letter stated, “While ExpressJet offers many attributes that make us an attractive long-term partner, cost has reared its ugly head once again, and we have been asked by our management team to close the gap between our costs and those at CommutAir.”

ExpressJet is considered bigger than CommutAir, with a more tenured staff and a larger fleet of about 95 compared to 37 at CommutAir.

On a July 22 Q2 earnings call, United Airlines CCO Andrew Nocella commented on the company’s future saying, “Our best guess is demand, as measured by revenue, will recover over time to be down approximately 50% and then plateau at that level until a vaccine is widely distributed.”

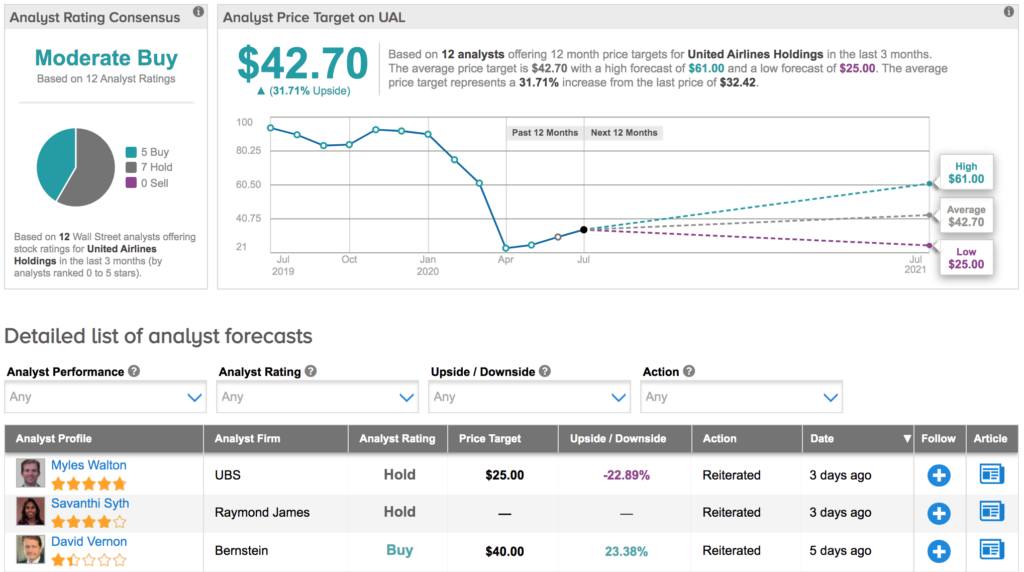

UBS analyst Myles Walton reduced his 2020 earnings estimate by 20% and raised his loss estimates for 2021 and 2022, saying that he believes the stock is relatively weak. He maintained a Hold rating on the shares and a price target of $25 which implies a downside potential of 23%

UAL stock is down 63% year-to-date with a Moderate Buy analyst consensus that breaks down into 5 Buy ratings versus 7 Hold ratings and no Sell ratings. The $42.70 average price target suggests 32% upside potential for the shares in the coming 12 months. (See UAL’s stock analysis on TipRanks).

Related News:

Boeing Is Said To Delay New 777X As Demand For Large Jets Throttles

Avolon Cancels 27 Of Boeing 737 Max Aircraft Order

American Airlines, JetBlue Partner To Boost Flight Options In Bid For Covid-19 Recovery