United Airlines Secures $5 Billion Loan to Shore Up $17 Billion Liquidity Chestited Airlines Holdings Inc (UAL) said it has secured $5 billion in financing from its MileagePlus loyalty program.

The financing is part of a plan to shore up $17 billion in available liquidity by the third quarter as the U.S. airline tries to navigate through the most severe “financial crisis in the history of aviation”. The loan facility is expected to close by the end of July.

In addition, United is looking to receive $4.5 billion through the U.S. Coronavirus Aid, Relief, and Economic Security Act (CARES Act) loan program. In a separate filing, the air carrier announced plans to sell as much as 28 million shares of its common stock.

In the third quarter, United expects to reduce its average cash burn to about $30 million per day from about $40 million per day in the second quarter, as it continues to see a steady improvement in demand for domestic U.S. and certain international destinations.

Furthermore, customer cancellation rates have dropped 70% since the high rates experienced in April. June ticketed passenger revenue is expected to be up close to 400% versus April. Net bookings for the rest of the second quarter and the third quarter have remained positive since the end of May, the airline said.

Looking to July, United expects passenger revenue to be up between 50% and 100% versus its June 2020 passenger revenue estimate.

Meanwhile, cargo revenues, which have been a significant driver of revenue and cash flow, are estimated to be up over 30% in the second quarter year-on-year. Overall, total revenues are now expected to be down 88% in the second quarter versus the same period last year.

Shares in United Airlines dropped 1.7% to $39 at the close on Monday. The stock has surged 62% over the past month, fueled by a broad stock market rally amid early signs of a gradual relaxation of some of the coronavirus-related lockdown restrictions. However, year-to-date it is still down 57%.

The sharp rally prompted Credit Suisse analyst Jose Caiado last week to lower the carrier’s rating to Hold from Buy with a $41 price target.

“UAL briefly overshot our target price following the recent sector rally, and while it has since settled in just below our TP (~15% upside), we still take this opportunity to step to the sidelines,” Caiado wrote in a note to investors. “We believe the recent rally off the bottom is an opportunity for investors to prudently reduce their exposure to the network carriers.”

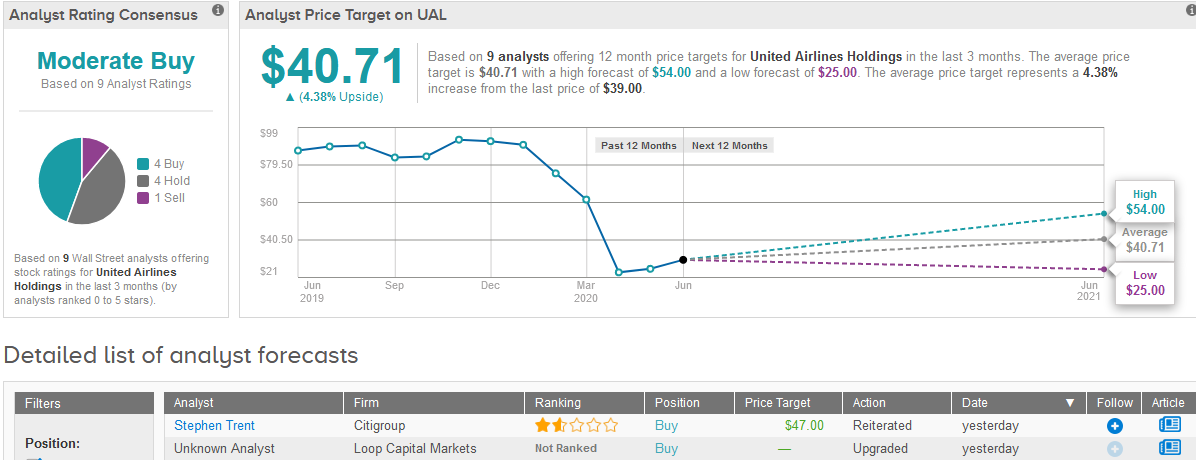

For now, it looks like Wall Street analysts are divided on the airline’s stock. The Moderate Buy analyst consensus breaks down into 4 Buys versus 4 Holds and 1 Sell. The $40.71 average price target is in line with Caiado’s forecast, which puts the upside potential at a conservative 4.4% in the coming 12 months. (See United Airlines stock analysis on TipRanks).

Related News:

Global Airlines Are Set To Lose $84.3 Billion In 2020, IATA Says

Boeing’s Aircraft Deliveries Drop In May As Cancellations Rise

Airbus Gets No New Aircraft Orders In May Amid Aviation Crisis