Under Armour stock fell about 4% on September 9 as the company disclosed in a regulatory filing the layoff of 600 employees and additional restructuring charges.

Footwear and athletic apparel maker Under Armour (UA) expects to incur $30 million in employee severance and benefit costs related to a reduction of about 600 employees primarily in its global corporate workforce.

The impact of the pandemic has forced the company to review its previously announced restructuring plan and it now expects $75 million of additional charges under the updated 2020 restructuring plan. This brings the estimated restructuring and related charges under the updated plan in the range of $550 million to $600 million. (See UA stock analysis on TipRanks)

In the first six months of this year, Under Armour recorded $340 million in restructuring and related charges and expects to record a majority of the remaining charges by the end of this year. The company has been under pressure due to rising competition in North America and an SEC investigation into accounting irregularities.

In reaction to the update, Raymond James analyst Matthew McClintock’s said that Under Armour continues to take prudent steps to restructure its business during unprecedented times and position itself for clean, profitable growth in 2021 and beyond. Lone bull McClintock has a Buy rating and a price target of $15 for Under Armour.

The analyst said “Our biggest takeaways from yesterday’s filing are: 1) there are no new incremental employee reductions related to this news as all headcount reduction was previously contemplated under earlier plans (confirmed). 2) CFO Dave Bergman has mentioned for several years the company’s intent to appropriately rationalize new and existing long-term contracts. 3) Most retailers we cover are in active discussions with landlords regarding facility and lease costs.”

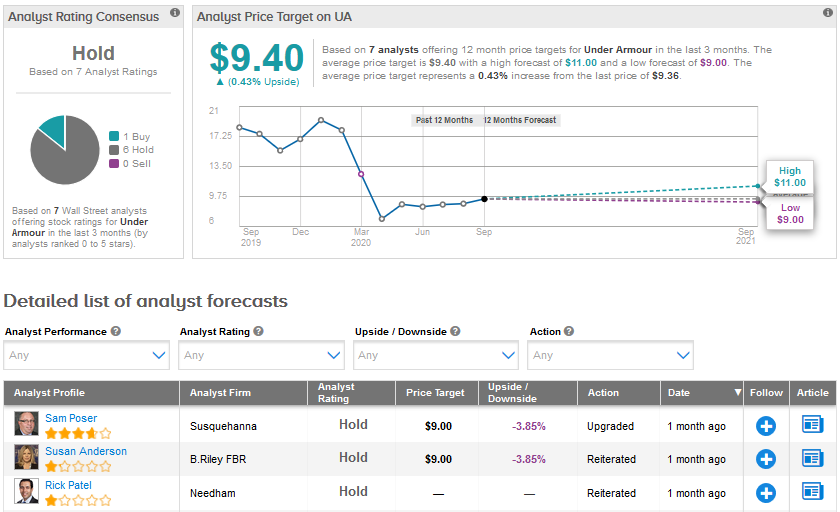

Overall, the Street has a Hold consensus for Under Armour based on 1 Buy and 6 Holds. The stock has plunged 51% year-to-date and the average analyst price target of $9.40 suggests barely any upside potential over the coming months.

Related News:

Lululemon Skids 6% As 3Q Profit Expected To Drop

Goldman Sachs Turns Bullish On Wyndham, Raises PT

KKR Plans To Inject Up To $1.5B In Reliance’s Retail Unit – Report