Shares in Under Armour (UA) plunged 10% after the athletic apparel maker warned of a possible 50% to 60% decline in second-quarter sales as its stores remain closed amid stay-at-home orders to contain the coronavirus pandemic.

Under Armour management provided the forecast as it released its first-quarter results.Total net revenue dropped about 23% to $930.2 million in the quarter ended March 31 versus the $949 million estimated by analysts. The sports apparel maker posted a net loss of $589.7 million, or $1.30 per share, compared with a profit of 5 cents per share, in the year-earlier period. Adjusted diluted loss per share amounted to 34 cents compared with market estimates of a 19 cent loss.

“During the first quarter, our results in January and February were tracking well to our plan. Since mid-March, as the pandemic accelerated dramatically in North America and EMEA and retail store closures ensued, we’ve experienced a significant decline in revenue across all markets.” Under Armour President and CEO Patrik Frisk said. “As a result, like so many businesses, we’ve had to make very difficult decisions, including temporarily laying off teammates in our U.S. retail stores and distribution centers along with other actions to ensure we protect Under Armour’s financial stability.”

The Baltimore-based retailer said that most of its stores in the U.S. and EMEA have remained closed since mid-March, while in China 80% of its stores had re-opened by the end of March.

In addition, Under Armour expects to reduce its originally planned 2020 operating expenses by about $325 million through various cost-cutting initiatives.

Shares in Under Armour tanked 10% to $8.94 in early afternoon U.S. trading, extending this year’s drop to 59%.

Following the results, Needham analyst Rick Patel maintained his Hold rating on the stock, saying that although progress is being made and capital preservation is becoming a bigger priority, it is not “enough to see significant upside to estimates”.

“Out Hold rating is based on low visibility on the company’s turnaround while Covid-19 creates another layer of uncertainty,” Patel wrote in a note to investors. “Under Armour has made progress in right-sizing its inventory and improving product, but it’s not yet clear if it can deliver higher sales in North America after Covid-19 headwinds ease.”

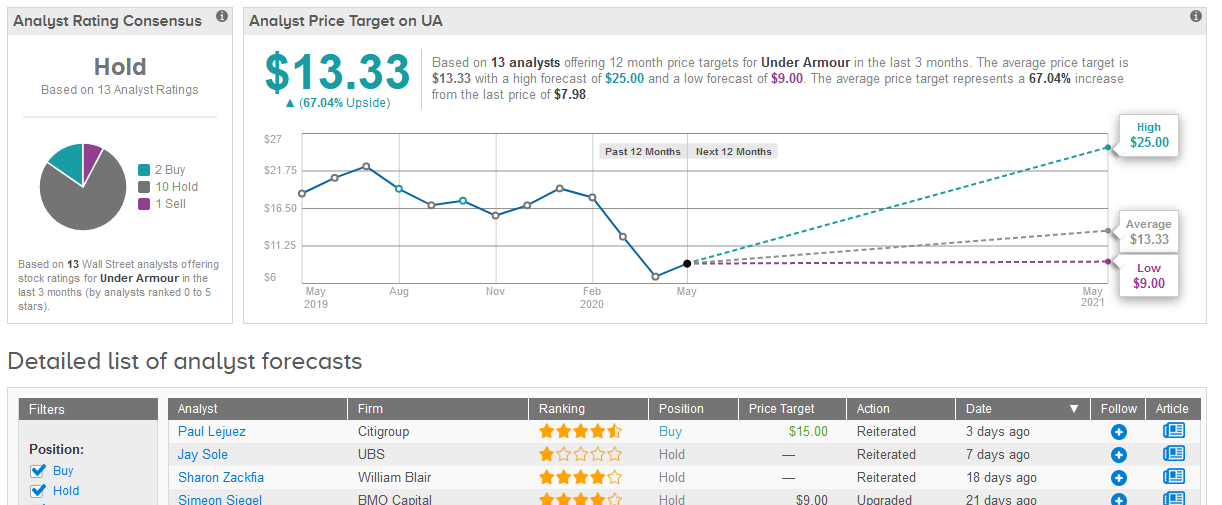

The remainder of Wall Street analysts are overly sidelined on the stock with 10 Holds, 2 Buys and 1 Sell adding up to a Hold consensus rating. The $13.33 average price target indicates 67% upside potential in the shares in the coming 12 months. (See Under Armour stock analysis on TipRanks).

Under Armour ended the first quarter with cash and cash equivalents of $959 million, of which about $600 million was tied to borrowings under its revolving credit facility. The company currently has $700 million outstanding under this facility, it said.

Related News:

Qantas Said to Halt Plane Deliveries From Boeing, Airbus Amid Travel Freeze

3 Stocks Needham’s Top Analysts Are Raving About

AMC Pops 11% Amid Potential Acquisition Talks by Amazon