Uber’s (UBER) share price declined 3.42% after-hours on Wednesday, despite the ride-hailing company reporting record gross bookings in 1Q 2021 that increased 24% year-on-year to $19.5 billion. Delivery Gross Bookings grew 166% year-over-year to $12.5 billion, while Mobility Gross Bookings declined 38% year-on-year to $6.8 billion.

Total revenue came in at $2.9 billion. However, it could have been much higher had it not been for a $600 million reduction due to claims arising from the classification of drivers in the UK. Delivery revenue increased 230% year-over-year to $1.7 billion.

Uber posted a net loss of $108 million, which included a $281 million charge incurred from a “stock-based compensation expense”. The net loss could have been much higher had the company not profited from a $1.6 billion boost following the ATG divestment. Adjusted EBITDA, on the other hand, improved by $253 million year-over-year to ($359) million.

According to Chief Executive Officer Dara Khosrowshahi, Uber is once again functioning at peak levels following COVID-19 disruptions last year.

Khosrowshahi stated, “We will continue to innovate and find new ways to deepen engagement with our customers, as the only global platform that helps you go wherever you need and get whatever you want.”

Weighing in on the first-quarter results, Chief Financial Officer Nelson Chai restated that the company is well-positioned to continue driving long term value. (See Uber stock analysis on TipRanks)

Oppenheimer analyst Jason Helfstein maintains a Buy rating on Uber with a price target of $79 per share. This implies 54.36% upside potential to current levels.

“Most importantly, April trends remain very strong in both Mobility (+280% y/y) and Delivery (+160%), and we are just at the beginning to see the synergistic benefits of an allinclusive App. While take-rate is being negatively impacted by a driver shortage, we expect this to correct given the above average wages being paid to drivers,” Helfstein wrote in a research note to investors.

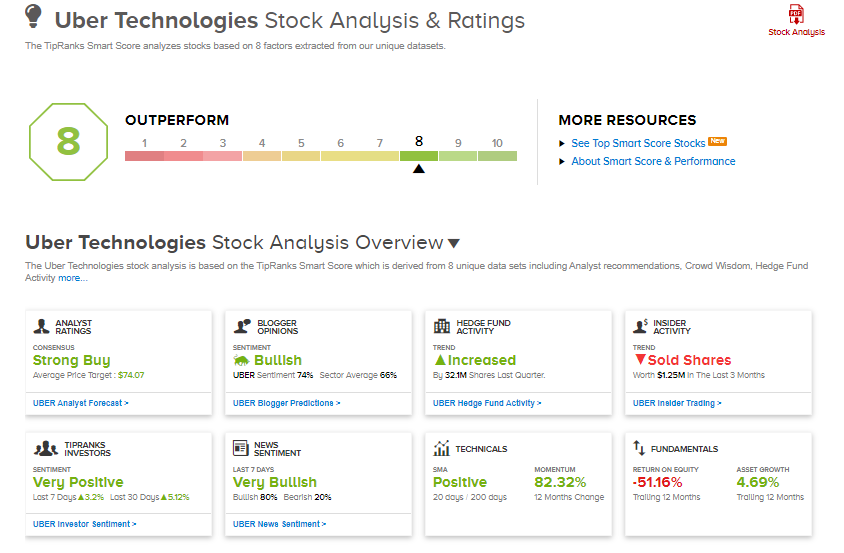

Consensus among analysts is Strong Buy based on 30 Buy and 3 Hold ratings. The average analyst price target of $74.07 implies 44.7% upside potential to current levels.

UBER scores an 8 out of 10 on TipRanks’ Smart Score rating system, implying it is likely to outperform the overall market.

Related News:

Facebook Unveils ‘Neighborhoods’ In Canada For Localized Connections

Apollo Global’s 1Q Results Shatter Records, Dividend Confirmed

T-Mobile Raises 2021 Guidance After Strong Q1 Earnings