Twilio reported stronger-than-expected 3Q results as sales and earnings rose from the year-ago period. However, shares of the cloud solution provider fell 1.6% in Monday’s extended trading session after it issued a weak earnings outlook for 4Q.

Twilio (TWLO) expects to report an adjusted loss per share of between $0.08 and $0.11 in the current quarter, while analysts are projecting adjusted EPS of $0.02. Meanwhile, the company’s revenue guidance range of $450-$455 million exceeded analysts’ expectations of $437.4 million.

Twilio’s revenues in 3Q soared 52% to $448 million year-on-year and beat Street estimates of $409.9 million. The company earned an adjusted $0.04 per share in the quarter, while analysts had expected a loss of $0.03 per share. EPS grew 33.3% year-on-year as the company has been benefiting from rising demand for cloud communication tools amid the pandemic-led remote working trend. (See TWLO stock analysis on TipRanks).

“Great digital engagement is becoming more critical to differentiate the customer experience, and companies across industries and around the world are choosing Twilio’s customer engagement platform to build these solutions,” Twilio’s CEO Jeff Lawson said. “Our performance in the third quarter is further evidence that Twilio’s platform provides three things that every company needs today — digital communications, software agility, and cloud scale.”

Earlier this month, Twilio confirmed that it is buying customer data startup Segment in an $3.2 billion all-stock deal.

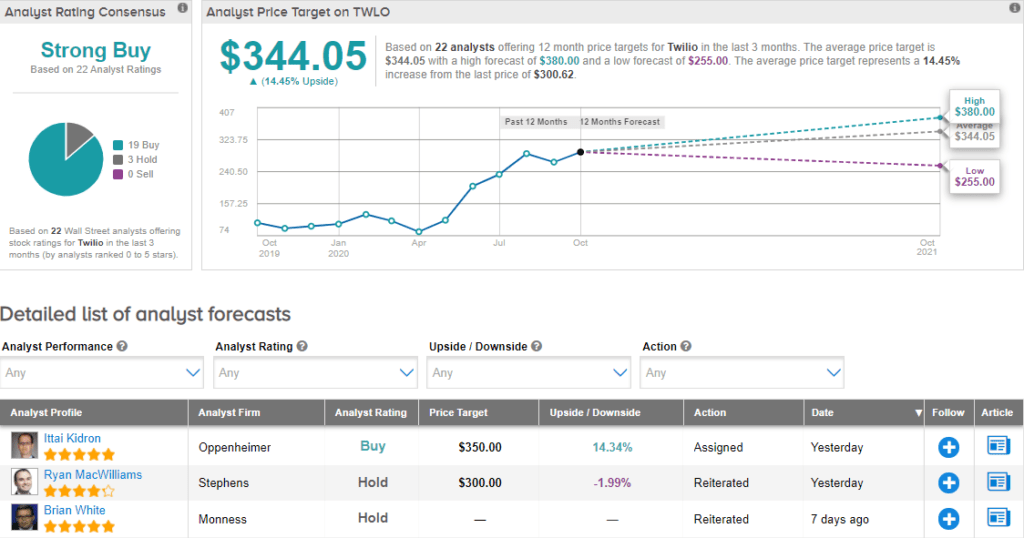

Following the earnings release, Stephens analyst Ryan MacWilliams reiterated a Hold rating and a price target of $300 (0.2% upside potential). In a note to investors, MacWilliams wrote, “Overall, Twilio posted a solid beat-and raise print, however, the pre-announcement ahead of its Segment acquisition took away much of the drama for this quarter, in our view.”

Currently, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 19 Buys and 3 Holds. With shares up nearly 206% year-to-date, the average price target of $344.05 implies additional upside potential of about 14.5% to current levels.

Related News:

Barnes’ 3Q Profit Drops 66%, Sees Lower 4Q Sales

Accenture Buys Spain’s Enimbos In Cloud Push

Seagate’s 1Q Sales Miss; Analyst Raises PT