Trane Technologies reported stronger-than-expected 4Q results on Friday. The climate control product manufacturer for homes, buildings, and transportation said strong execution and productivity savings fueled quarterly earnings.

Trane Technologies’ (TT) adjusted earnings of $1.03 per share jumped 12% year-over-year and came in ahead of the consensus estimate of $0.93 per share. The year-over-year growth reflects a 14% increase in operating income.

The company’s adjusted EBITDA and adjusted operating margin expanded by 140 basis points and 150 basis points, respectively, due to higher average realized prices and productivity savings.

Trane Technologies’ top-line remained flat at $3.18 billion but surpassed analysts’ estimates of $3.08 billion. Bookings improved by 4% year-over-year. The company’s revenue increased 1% year-over-year in the Americas, its largest business segment by sales. However, revenue remained weak in Europe, the Middle East and Africa (EMEA) and in the Asia Pacific regions.

Looking ahead, Trane Technologies remains upbeat and expects to report adjusted EPS in the range of $5.30 to $5.50 in 2021, reflecting year-over-year growth of 19% to 23%.

The company’s CEO, Mike Lamach, said “Despite ongoing pandemic-related challenges in 2021, we remain confident that we have the fundamental ingredients for another year of resilient financial performance, strong free cash flow and balanced capital deployment that will deliver continued, differentiated returns for shareholders.” (See Trane Technologies stock analysis on TipRanks)

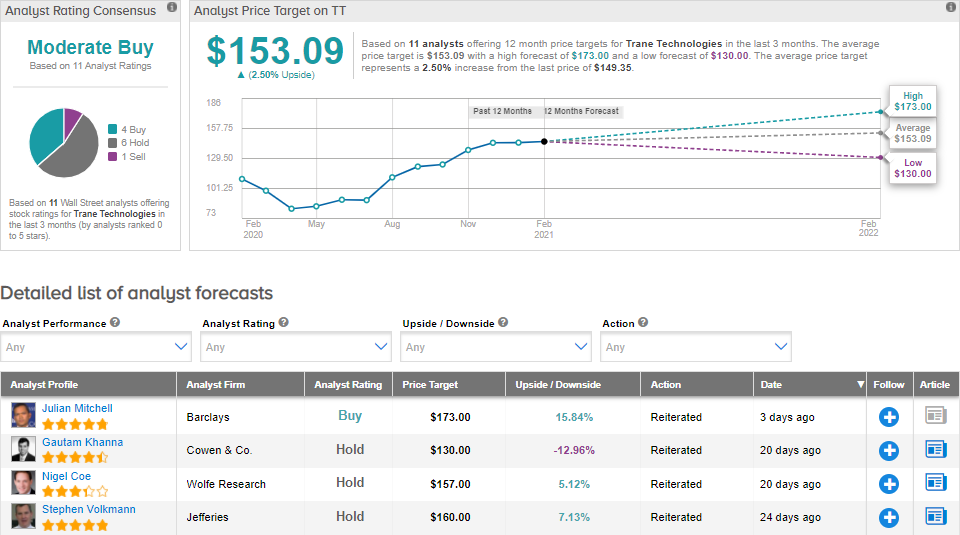

Following the earnings results, Cowen & Co. analyst Gautam Khanna maintained a Hold rating on the stock with a price target of $130 (about 13% downside potential).

Khanna said, “Q4 results were strong, & initial Q1 guidance (implies near $0.66 vs. Street’s $0.54) & C21 guidance ($5.40 midpoint vs. Street’s $5.17) are well above Street. These factors should sustain TT’s premium valuation.”

Overall, the Street has a Moderate Buy consensus rating based on 4 Buys, 6 Holds, and 1 Sell. The average analyst price target of $153.09 implies upside potential of 2.5% to current levels. Shares have gained about 41.6% in one year.

Related News:

Shoe Carnival’s 4Q Profit Outlook Tops Estimates; Shares Gain 5%

Illinois Tool’s ‘Record’ Operating Margin Drives 4Q Profit Beat

Pinterest 4Q Earnings Beat Estimates; Shares Pop 11.7% Pre-Market