Shares of Thor Industries (THO), the world’s largest recreational vehicle or RV maker, are up 6.2% in the pre-market trading hours as the company’s results for the fourth quarter of fiscal 2020 (ended July 31) surpassed analysts’ expectations.

The 4Q EPS grew 28.1% Y/Y to $2.14 supported by higher sales, lower selling, general and administrative expenses and the company’s cost reduction measures. Analysts expected EPS of $1.28.

Fiscal fourth-quarter sales grew 0.55% Y/Y to $2.32 billion, beating analysts’ estimate of $2.24 billion. Sales were driven by a 2.8% rise in sales of the European RV business which gained from a favorable product mix and selective price hikes. Also, sales of the North American Towable RV segment grew 1.7%.

However, sales of the North America Motorized RV segment decreased 5.4% due to lower unit sales and an unfavorable product mix comprising a higher volume of modestly priced Class B motor homes.

The company experienced increasing retail demand over the course of the fiscal fourth quarter which drove the dealer inventories to historically low levels by the end of the quarter. Also, the fiscal 2020 year-end backlog touched a record high. Since the easing of social distancing restrictions, RV vehicles have been in demand as air and cruise travel are still not considered as safe options amid rising COVID cases.

President and CEO Bob Martin commented, “Looking ahead, we expect a year of continued growth in fiscal 2021, and we concur with RVIA’s [RV Industry Association] recent RoadSigns most likely forecast of an approximate 19.5% increase in calendar 2021 shipments over their most likely estimate for calendar 2020 shipments.” (See THO stock analysis on TipRanks)

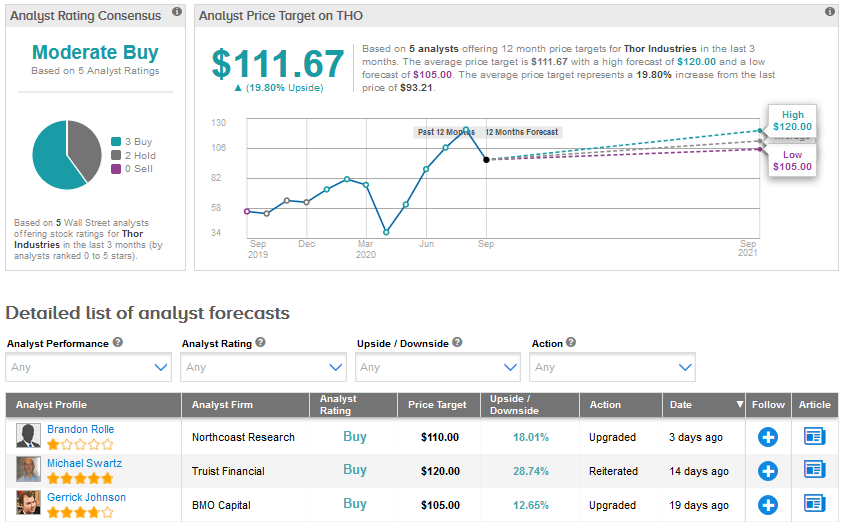

Prior to the 4Q results, Northcoast analyst Brandon Rolle upgraded Thor Industries to Buy from Hold with a price target of $110. The Street has a Moderate Buy consensus for Thor Industries based on 3 Buys, 2 Holds and no Sell ratings.

Thor Industries stock has risen 25.4% year-to-date and the average analyst price target of $111.67 suggests an additional upside of 19.8% in the coming months.

Related News:

AAR Soars 10%, Beats 1Q Estimates Despite Covid’s Impact

Lockheed Ramps Up Dividend By 8.3%, Boosts Share Buyback By $1.3B

Raytheon Wins $212.8M US Missile Contract For UAE; Street Is Bullish