An investigation into 63,000 Tesla (TSLA) Model S cars has been opened by the U.S. National Highway Traffic Safety Administration (NHTSA) following complaints about failures of the media-control unit that cause loss of touchscreen features.

Shares dropped 3.8% to $963.34 in early afternoon trading on Wednesday.

The NHTSA said that it has received 11 complaints alleging failures of the touchscreen media control unit (MCU) due to memory wear-out in 2013 through 2015 Tesla Model S vehicles. The complaints have been filed over the past 13 months in vehicles that have been in use from 3.9 years to 6.3 years.

Total failure of the MCU unit results in the loss of audible and visual touchscreen features, such as infotainment, navigation, and web browsing, according to the NHTSA. This includes loss of rear camera image display when in reverse gear, which leads to reduced rear visibility when backing.

The display control unit uses an Nvidia (NVDA) Tegra 3 processor with an integrated 8GB eMMC NAND flash memory device.

The NHTSA added that other effects of MCU failure include climate control defaulting to auto mode and battery charging issues. However, the U.S. agency said that the failure does not affect vehicle control systems such as braking, steering, or speed control.

A preliminary evaluation will assess the scope, frequency, and safety consequences of the alleged defect and depending on the findings could result in a recall action of Tesla vehicles.

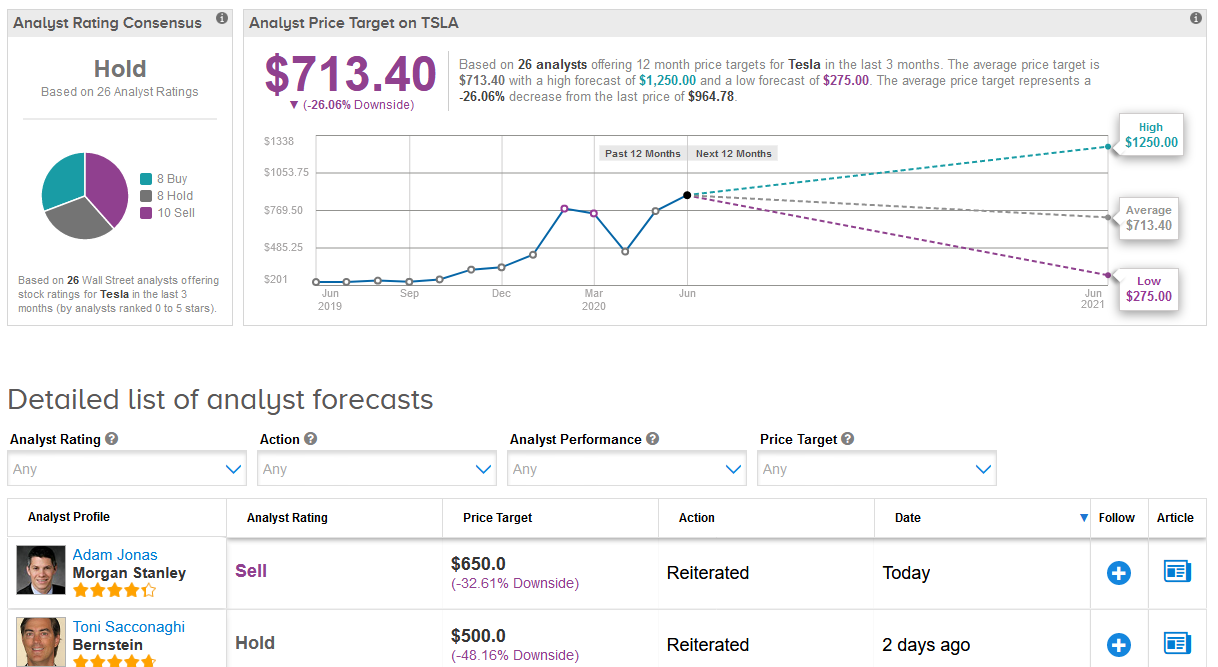

Tesla shares have this year seen a great run and have now more than doubled in value. Morgan Stanley analyst Adam Jonas, says the stock’s high valuation has been driven by “tech-oriented investors” who seem to ignore “a host of execution/market risks” that a car company like Tesla is dealing with.

Jonas maintains a Sell rating on the stock with a $650 price target, reflecting 33% downside potential in the shares over the coming year.

Overall, the stock has a Hold analyst consensus with 10 Sell ratings and 8 Hold ratings versus 8 Buy ratings. The $713.40 average price target implies 26% downside potential. (See Tesla’s stock analysis on TipRanks).

Related News:

Nvidia, Mercedes Partner On Autonomous Vehicle Venture; A ‘Match Made In Auto Heaven’ Says Oppenheimer

Tesla Said To Have Won Chinese Nod To Build Model 3 With LFP Batteries

Can Tesla Provide the Million Mile EV Battery? Top Analyst Weighs In