A court in Norway has found Tesla (TSLA) guilty of using a software update to slow the charging speed and reduce the driving range of its electric cars. Tesla stock jumped 4.40% on Monday to close at $606.44.

In 2019, Tesla released a software update for its cars. Soon after, some drivers started noticing a drop in charging speed and a decline in range. Some lost as much as 30 miles in range. The problems mainly were reported by owners of old Model S cars produced between 2013 and 2015.

When the complaints started emerging, Tesla explained that the software update causing the problems was intended to protect the battery and improve its life. It also said that only a handful of cars had been affected.

The affected drivers sued the company in several countries worldwide, including the U.S., Norway, and Denmark. In Norway, Tesla has been asked to pay 136,000 kroner (around $16,000) to each of the affected customers.

As there are more than 10,000 Model S cars likely affected in Norway, the company could have to part with $160 million to compensate the drivers. Tesla is required to pay the fine by May 31 or appeal the decision by June 17. (See Tesla stock analysis on TipRanks)

Wells Fargo analyst Colin Langan initiated Tesla stock coverage with a Hold rating and a price target of $590. Langan’s price target suggests 2.71% downside from the current price.

Langan believes the stock’s price accounts for the 12 million deliveries Tesla plans by early next decade. He is concerned, however, that the market will not be able to absorb all the cars that Tesla and other EV manufacturers are planning to deliver.

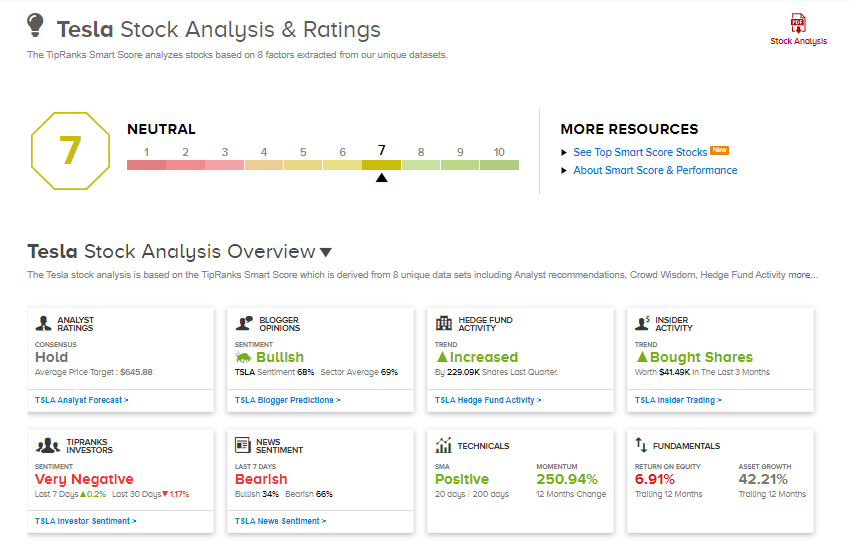

Consensus among analysts on Wall Street is a Hold based on 10 Buy, 8 Hold, and 7 Sell ratings. The average analyst price target of $645.88 implies 6.50% upside potential to current levels.

TSLA scores a 7 out of 10 on TipRanks’ Smart Score rating system, suggesting the stock’s returns are likely to align with the market’s performance.

Related News:

Square Partners with Plaid on ACH Payment for Merchants

Tinder Partners with White House to Accelerate COVID-19 Vaccinations

Intel, SK Hynix Win EU Approval for Memory Unit Sale