Tesla Inc.’s (TSLA) CEO billionaire Elon Musk disclosed that its Model Y is facing production and supply chain issues after production at its main Fremont auto plant was resumed last month.

According to a leaked e-mail to employees seen by Electrek, the ramp up of Model Y production capacity to pre-Covid 19 levels is expected to take a while.

“It is extremely important for us to ramp up Model Y production and minimize rectification needs,” Musk wrote in the email. “I want you to know that it really makes a difference to Tesla right now.”

The vehicle maker was given a green light last month to resume production after the shutdown at its main Fremont auto plant ending a stand-off with Alameda County over coronavirus-related safety measures.

In addition, Musk pointed to needed car fixtures in the regular production process.

“Model Y, especially GA (stands for General Assembly), is the top priority for both production and manufacturing engineering,” he wrote. “GA4 (stands for General Assembly Line 4) is also top priority for facility improvements.”

GA4 is Tesla’s assembly line, which enabled the Model 3 production capacity to reach 5,000 units per week.

“We are doing reasonably well with S, X, and 3, but there are production and supply chain ramp challenges with Model Y,” Musk wrote.

Tesla shares, which have this year more than doubled, surged another 7% to $949.92 on Monday after a report showed the vehicle maker sold 11,095 Shanghai-made Model 3 vehicles in China in May. The figure is more than triple the volume seen in April, according to the China Passenger Car Association (CPCA).

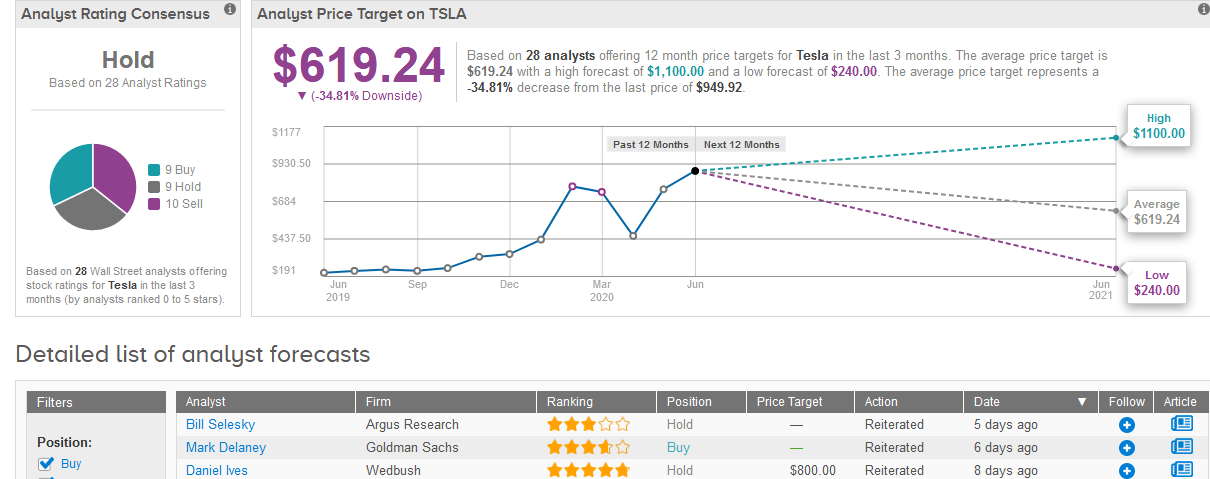

In view of the sharp rally, Wall Street analysts now take a cautious stance on the company’s stock. Overall, it has a Hold consensus based on 10 Sells, 9 Holds, and 9 Buys.

The Street’s $619.24 average price target implies 35% downside potential in the shares over the coming year. (See Tesla’s stock analysis on TipRanks).

Meanwhile, five-star analyst Daniel Ives at Wedbush at the end of last month raised the stock’s price target to $800 (16% upside potential) from $600, while maintaining a Hold rating, saying that the target of 400k deliveries globally for the year (down from original 550k pre-COVID) remains on track and could prove to be conservative depending on the pace of the lockdowns easing globally.

“In what has been a defining chapter of challenges and skeptics around the Tesla story, the company has instead curtailed its cost structure while getting the engines back running in Fremont to meet underlying pent-up consumer demand which remains volatile given the current near-term backdrop,” Ives wrote in a note to investors.

Related News:

Tesla Sales Triple For China Model 3 Vehicle In May

Grubhub Shares Lifted On Report Of European Acquirers Lining Up

Can Tesla Provide the Million Mile EV Battery? Top Analyst Weighs In