Target Corp. benefited from booming online sales growth during the holiday period as consumers piled up on their shopping from home due to pandemic-led restrictions.

Target (TGT) saw its comparable sales grow 17.2% in November through December as comparable digital sales spiked 102%. Additionally, the retail chain’s store traffic rose 4.3% and average ticket grew 12.3%. Store-originated comparable sales rose 4.2%. Sales growth was strongest in the retailer’s home and hardlines segment.

The retailer said that its contactless same-day services, which includes ordering online and picking up at the store, with curbside pickup, contributed to the performance. In December alone, customers bought 150 million items using the Drive Up and Order Pickup services, four times more than during the same period last year.

“The momentum in our business continued in the holiday season with notable market share gains across our entire product portfolio,” Target CEO Brian Cornell commented. “Throughout the holidays, we delivered joy for holiday shoppers while focusing on safety—adjusting promotions to reduce crowding while delivering easy, contactless fulfillment options through Drive Up and Shipt.”

“We’ve seen continued strong sales trends in the new year, and as we turn to our 2021 plans, our team is focused on continuing to build on the guest engagement and significant market share we gained throughout 2020,” Cornell added.

Ahead of the holiday sales update, Credit Suisse analyst Seth Sigman this week reiterated a Buy rating on the stock with a Street-high price target of $211 (6% upside potential), as he sees potential for fourth-quarter sales to outperform. Sigman lifted his estimate for Q4 comparable sales to at least 20% from 17%.

The analyst views TGT “as one of our better positioned retailers, both in the short-term (easy holiday comparisons, wallet share shifts, stimulus, share gains) and in a more normal environment (customer growth, category diversity, merchandising opportunities such as the Ulta partnership, cost offsets, and more share gains), supported by our normalized EPS analysis pointing to ~$10/share.” (See Target stock analysis on TipRanks)

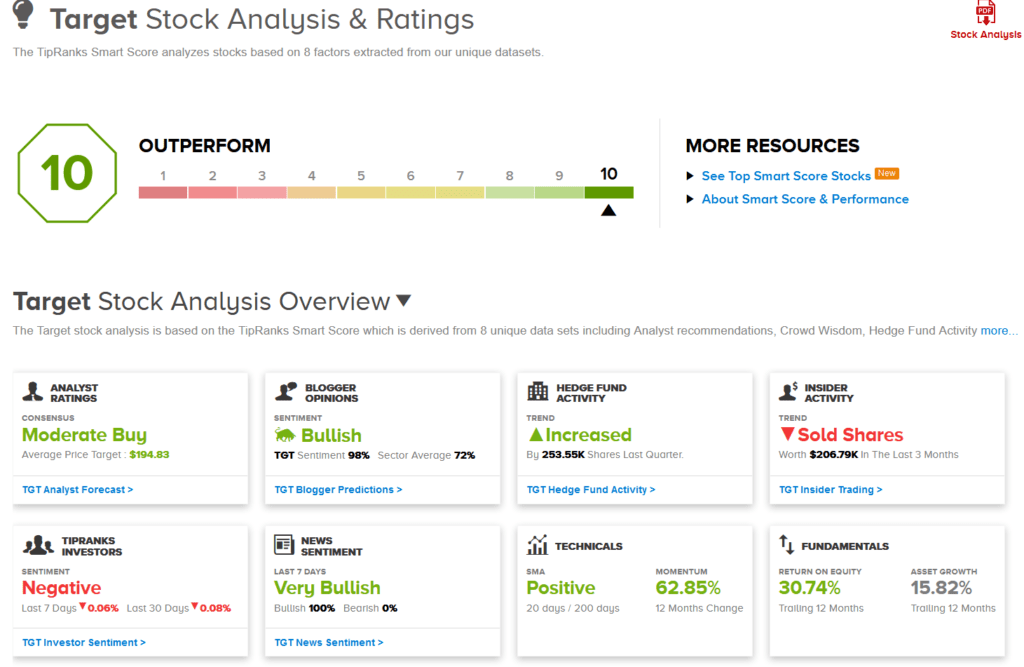

The rest of the analyst community is cautiously optimistic on the stock. The Moderate Buy consensus shows 14 Buys versus 5 Holds. The average price target stands at $194.83 and implies 2.1% downside potential over the coming year. That’s after shares surged 60% over the past year.

Meanwhile, TipRanks’ Smart Score system shows that Target scores a perfect 10, which indicates a high likelihood of outperformance.

Related News:

Albertsons Tops 3Q Results As Online Sales Pop 225%

Zoom Announces $1.75B Public Offering; Sells 1M Phone Seats

Crocs Gains 8% On Upbeat 3Q Sales Outlook