Square reported better-than-expected 4Q results and registered robust year-over-year growth. However, shares of the financial services and mobile payment solution provider fell 5.7% in Tuesday’s extended trading session as its gross payment volume (GPV) missed estimates.

Square’s (SQ) 4Q adjusted earnings increased 39% to $0.32 per share year-over-year and beat Street estimates of $0.24. Revenues of $3.16 billion came in ahead of the consensus estimate of $3.11 billion and marked a year-over-year improvement of 141%. However, excluding bitcoin sales, total revenue was $1.4 billion.

Square revealed that it processed $32 billion in GPV during the quarter, up 12% year-on-year. However, 4Q GPV fell marginally short of analysts’ expectations of $32.1 billion.

The company’s overall financial results were driven by strong momentum across its Cash App segment, which contributed $2.17 billion to net revenues in 4Q, up 502% from the year-ago quarter. The business unit benefited from the strong adoption of bitcoin, with it generating $1.76 billion in revenues.

Sales at its Seller ecosystem grew 5% to $987 million. (See Square stock analysis on TipRanks)

Additionally, Square provided a business update for January 2021. Cash App’s gross profit increased 164% year-over-year, which was moderately higher than the 4Q growth of 162%.

The seller division’s gross profit was up 15% year-on-year, slightly higher than the 4Q increase of 13%. Seller’s GPV growth of 5% in January was slightly lower than the 6% increase registered in 4Q.

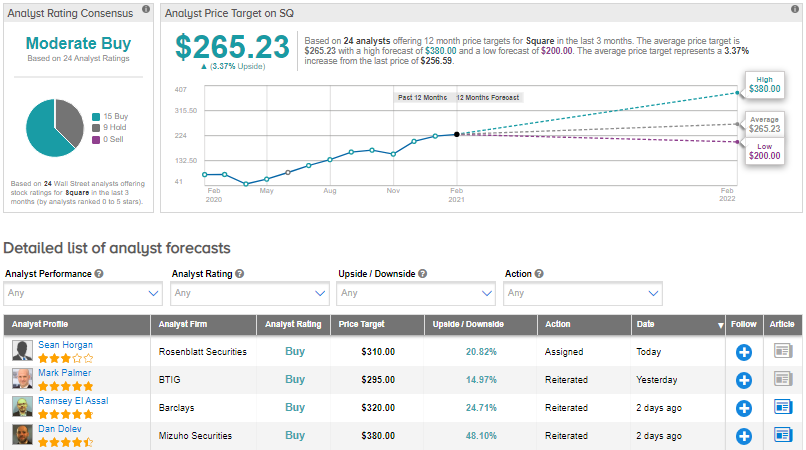

Ahead of the earnings release, Barclays analyst Ramsey El Assal raised the stock’s price target to $320 (25% upside potential) from $260 and reiterated a Buy rating. In a note to investors, Assal stated that Square’s Cash App ecosystem revenues have surged massively, but the product is relatively young. The analyst projects the company’s revenues to cross the $10 billion mark by 2025, reflecting a CAGR of 50%.

Overall, the Street has a cautiously optimistic outlook on the stock, with a Moderate Buy consensus rating based on 15 Buys and 9 Holds. The average analyst price target of $265.23 implies upside potential of about 3.4% from current levels. Shares have skyrocketed about 220% over the past year.

Related News:

Brink’s Quarterly Sales, Profit Top Expectations; Shares Rise

Crocs Posts Record Sales Quarter; Shares Sink 5%

Macy’s Beats 4Q Sales Estimates, Sees Recovery In 2021; Shares Drop 2.6%