SailPoint Technologies announced its plan to acquire SaaS governance provider ERP Maestro. SailPoint provides identity security solutions for the cloud enterprise space, with the company hoping to combine identity security with ERP Maestro’s Separation-of-Duty (SoD) controls monitoring for critical applications such as SAP.

SailPoint’s (SAIL) EVP of products, Grady Summers, said, “With today’s threat landscape, organizations are challenged with ensuring proper governance and compliance over their most sensitive systems and data. It is important to ensure that these systems are only accessed by the right people, at the right time. People who need access to critical applications and systems to keep the business running are especially at risk as they hold the key to sensitive data.”

Summers further added, “ERP Maestro’s flexible and extensible approach allows for agile, automated and robust monitoring of an organizations’ most complex business critical systems. Extending identity security to include rich SoD controls monitoring will give SailPoint customers the chance to operate on a least privilege basis, providing only the necessary, appropriate system access and shutting down potential areas of SoD violations.” (See SailPoint stock analysis on TipRanks)

It should be noted that with this acquisition, SailPoint’s identity platform will be able to offer a unified view and real-time, actionable inputs to analyze logical access to businesses.

On March 11, Wedbush analyst Daniel Ives reiterated a Buy rating and set a price target of $80 (42% upside potential) on the stock. Despite the recent sell-off in tech stocks, Ives remains bullish on the sector. He commented, “This is just a painful, brutal valuation digestion period for tech stocks in their early stages of growth and a short-term sell-off in the midst of a multi-year bull rally we expect to go well into 2022.”

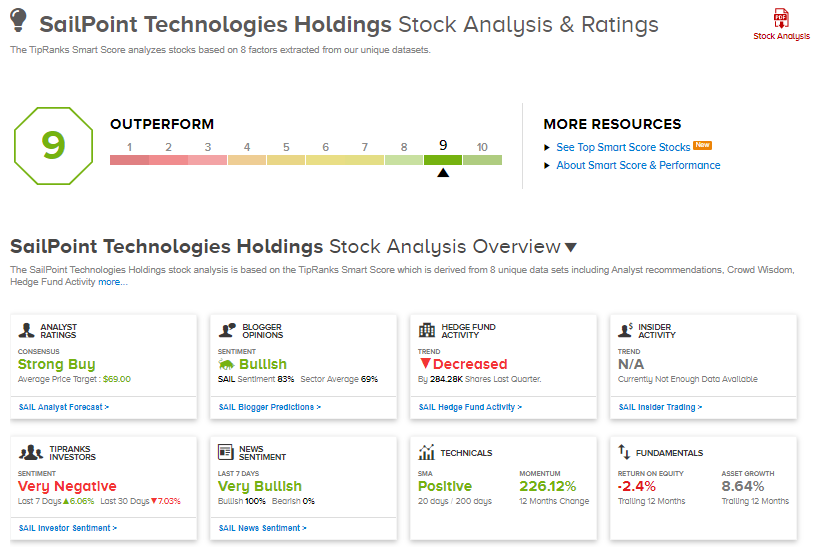

Turning to other Wall Street analysts, SailPoint has a Strong Buy consensus rating based on 11 unanimous Buys. The average analyst price target of $69 implies about 22.6% upside potential from current levels. That’s after the stock has seen a run-up of about 226% over the past year.

Furthermore, SailPoint scores a 9 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

AutoWeb Jumps 10% On Lower-Than-Feared 4Q Loss

Ulta Beauty Drops 8% Pre-Market On Softer 4Q Results, CEO Change

Wheaton Precious Metals Hikes Dividend By 30% As Quarterly Results Disappoint