Fast food holding company Restaurant Brands International Inc. (NYSE:QSR) recently revealed that its subsidiary, Popeyes Louisiana Kitchen, Inc., which operates the Popeyes brand, has entered into an exclusive Master Franchise and Development Agreement with a subsidiary of the Silla Group to launch hundreds of Popeyes restaurants across South Korea in the coming years. The first restaurant is scheduled to open in 2022.

The Silla Group is a South Korean conglomerate with interests in F&B restaurants, sea-food distribution, deep-sea fishing, agriculture, and industrial manufacturing.

Strategic Impact

Popeyes will be aiming to bring its digital innovation to South Korea while offering a hassle-free experience to its customers by incorporating digital screens and mobile ordering.

Notably, the ensuing launch in South Korea of the Popeyes brand is in line with the company’s global expansion plans.

Management Commentary

The President of Restaurant Brands, David Shear, said, “We are thrilled to launch Popeyes® with the Silla Group subsidiary. We have strong confidence in the group and are pleased to announce exciting plans to bring our iconic Louisiana-style chicken to one of the largest chicken QSR markets in the world.”

See Top Smart Score Stocks on TipRanks >>

Analyst Ratings

On January 3, Piper Sandler analyst Nicole Miller Regan downgraded the stock from Buy to Hold with a price target of $47.39, which implies downside potential of 21.2% from current levels.

The analyst said, “We view the franchised nature and higher-than-peer unit growth profile as compelling aspects of the RBI investment thesis, but believe these are not enough to move the needle in 2022 given a backdrop of lackluster same-store sales. Our lower top-line and EPS estimates reflect underperformance at Burger King and Tim Hortons (relative to peers) and moderating middle of the P&L leverage. Share repurchase activity and the recent acquisition of the Firehouse Subs brand are both net positives overall, but unlikely to produce meaningful earnings upside. Our Neutral rating could prove conservative as recent survey work suggests a favorable read-through for Burger King. That said, we believe shares are likely range-bound until strengthening top-line trends materialize. We are moving to a Neutral rating and $60 price target based on ~17x our FY22E EV/EBITDA.”

The Wall Street community is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 11 Buys and 11 Holds. The average Restaurant Brands stock prediction of $66.74 implies that the stock has upside potential of 11% from current levels. Shares have gained about 1.3% over the past year.

News Sentiment

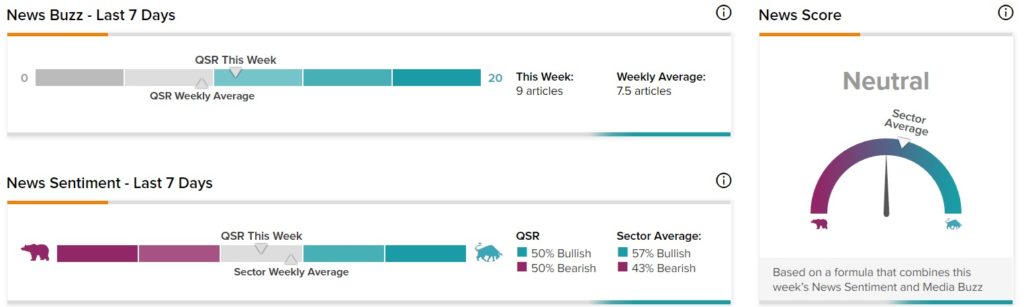

News Sentiment for Restaurant Brands is Neutral based on 7.5 articles over the past seven days. 50% of the articles have Bullish sentiment, compared to the sector average of 57%.

Download the mobile app now, available on iOS and Android.

Related News:

CNH Industrial Completes Demerger with Iveco Group; Shares Rise

Rexford Buys Eight Industrial Properties for $270M

Southwestern Energy Closes GEP Haynesville Buyout