China-based e-commerce platform Pinduoduo, Inc. (PDD) has reported mixed results for the third quarter of 2021, as the company’s revenue lagged but earnings surpassed the consensus estimate. Following the news, shares of the company fell 15.9% on Friday.

Revenues jumped 51% year-over-year to RMB21.5 billion ($3.3 billion) but lagged the Street’s estimate of RMB25.8 billion ($4 billion). The upside was primarily due to higher revenues from online marketing services.

Earnings came in at RMB0.29 per share and beat the analyst’s expectations of a loss of RMB0.46 per share. The company had reported a loss of RMB0.16 in the year-ago period.

Average monthly active users during the quarter increased 15% year-over-year to 741.5 million. Also, active buyers, as of September 30, 2021, rose 19% to 867.3 million. (See Pinduoduo stock charts on TipRanks)

The Chairman and CEO of Pinduoduo, Lei Chen, said, “We are placing more focus on investments in R&D, away from the previous emphasis on sales and marketing in our first five years. We want to leverage our strength in technology to deepen our digital inclusion efforts in agriculture, and will allocate all profits from the third quarter to the ‘10 Billion Agriculture Initiative’”

Stock Rating

Overall, the stock has a Hold consensus rating based on 1 Buy and 3 Holds. The average Pinduoduo price target of $103 implies 53.4% upside potential from current levels. Shares have lost 50.7% over the past year.

Bloggers Opinion

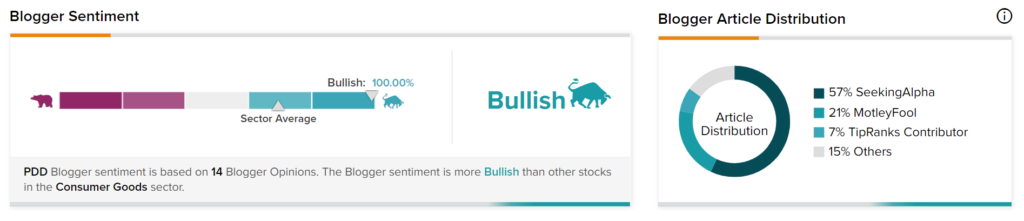

TipRanks data shows that financial blogger opinions are 100% Bullish on PDD, compared to the sector average of 70%.

Related News:

Mastercard, Jeeves Join Hands to Make Credit Access Easy for Mexican Businesses

Cabot to Sell Purification Solutions Business for $111M; Street Says Buy

Novartis Aims to Make Healthcare Affordable in Sub-Saharan African Region