U.S. drugmaker Pfizer Inc. (PFE) on Wednesday announced an initiative to invest up to $500 million in biotechnology companies to help provide funding for the industry’s most promising clinical development programs.

The investment, which will be channeled through the establishment of the so-called Pfizer Breakthrough Growth Initiative, also seeks to ensure the continuity of the biotechs’ clinical development programs, the company said in a statement.

“There has never been a more important moment to pursue new collaborations in our industry,” said Pfizer’s Chief Business Officer John Young. “The Pfizer Breakthrough Growth Initiative seeks to do just this by injecting crucial capital into biotechnology companies that share our commitment to delivering transformative therapies for patients.”

The initiative will focus on making non-controlling equity investments in clinical-stage public companies. The primary focus will be on companies with small- to medium-sized market capitalizations across a range of therapeutic categories that are consistent with Pfizer’s core areas of focus: internal medicine, inflammation & immunology, oncology, rare disease, and vaccines.

Potential partner companies will get access to Pfizer’s expertise and resources in research, clinical development and manufacturing.

Pfizer said that the investment program builds on Pfizer’s long history of successfully collaborating across the healthcare innovation ecosystem, through a wide range of flexible partnering and funding models, with the shared goal of turning science into innovative new medicines.

The announcement comes after the drugmaker reported a disappointing outcome for its Phase 3 PALLAS early breast cancer study sending shares down this week.

The stock dropped 7.2% to $35.46 as of Monday’s close after it advanced some 30% since the end of March.

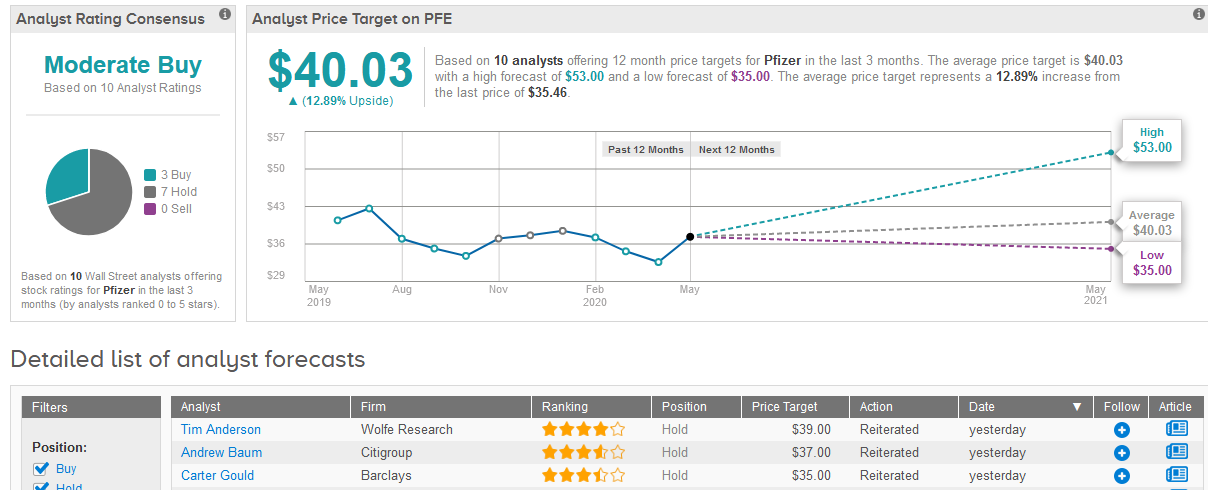

Following the breast cancer study results, Barclays analyst Carter Gould trimmed the drugmaker’s price target to $35 from $37 and maintained a Hold rating on the shares.

In view of Pfizer’s disclosure that the Ibrance Phase 3 PALLAS study was being stopped for futility, Gould removed all adjuvant sales from the model, while also lowering his 2025 sales estimates by about $2 billion, and the 2020-2025 annual earnings growth estimate to 3.3% from 4.1%.

Overall, Wall Street analysts are cautiously optimistic on Pfizer’s shares with 7 Hold and 3 Buy ratings. This gives the stock a Moderate Buy consensus with a $40.03 average price target (13% upside potential to current levels). (See Pfizer stock analysis on TipRanks).

Related News:

Pfizer Loses 6% On Disappointing Ibrance Breast Cancer Outcome

BioMarin Provides Positive Gene Therapy Update For Severe Hemophilia A

Efgartigimod’s Positive Data Is Good News for Momenta’s Nipocalimab