France’s Orange SA announced an exclusive agreement to divest 50% of its fixed fibre assets for about €1.3 billion ($1.58 billion) to help rollout networks in rural France.

As part of the deal, Orange (ORAN) has agreed to sell a 50% equity interest of Orange Concessions to a consortium of three investors, which are La Banque des Territoires (Caisse des Dépôts), CNP Assurances (CNP) and EDF Invest. The transaction, which is expected to close by the end of 2021, values Orange Concessions at €2.675 billion. As part of the deal, Orange and the consortium of investors will enter into a partnership to co-control the fibre network assets.

According to the telecoms operator, Orange Concessions will be France’s leading fibre-to-the-home (FTTH) operator of networks, which will be rolled out and operated on behalf of local public authorities. Orange Concessions will offer 23 public initiative networks (PIN) and deploy over 4.5 million built or to-be-built plugs in rural areas in France.

“I am delighted that Orange, Europe’s leader in fibre roll-out, is now set to establish this partnership in its domestic market with recognized investors who share our vision of digital communication infrastructure development,” Orange CEO Stéphane Richard stated. “Through this partnership, Orange holds the means to pursue the development of fibre in rural areas, by winning new public initiative networks or by participating in market consolidation.”

“As to its financial merits, the achieved valuation reveals the value of Orange’s investments in fibre as well as the relevance of such strategic move,” Richard added.

As part of the partnership, Orange will be the operator of the fibre network rollout and maintenance. Moreover, Orange also retains a call option to take control and consolidate Orange Concessions in the future.

Shares of Orange are down 2.1% over the past month and have dropped 19% over the past year. (See ORAN stock analysis on TipRanks)

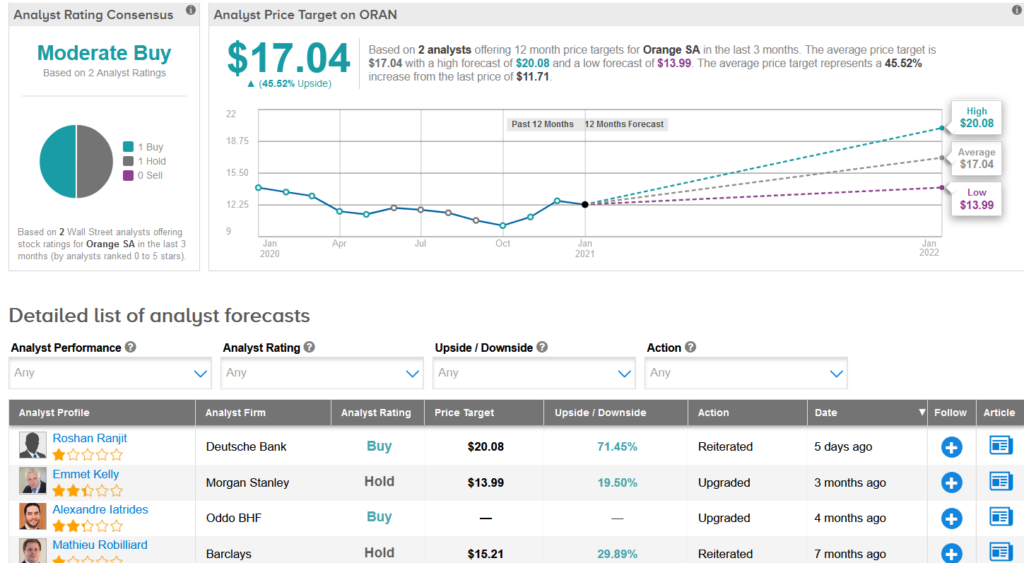

Meanwhile, Wall Street analysts have a cautiously optimistic Moderate Buy consensus on the stock based on 1 recent Buy rating versus 1 Hold rating. That’s with an average price target of $17.04, implying that 46% upside potential lies ahead in the coming months.

Related News:

GlobalWafers Hikes Takeover Offer For Siltronic By 16%

Kansas City Sees Double-Digit Sales Growth In 2021

Ally Financial Crushes 4Q Estimates Driven By Lower Provisions