Okta reiterated its financial outlook on Wednesday in an Investor Day presentation and unveiled its new products. The identity-management platform provider expects revenues to range between $1.08 billion to $1.09 billion in FY22, up by 29% to 30% year-on-year. The company’s financial outlook does not include the potential impact of the impending acquisition of Auth0.

Okta (OKTA) also said that it foresees revenues of between $237 million and $239 million in the first quarter of FY22, a rise of 30% to 31% year-on-year. Separately, the company also expanded its service offerings with two new products, Okta Privileged Access and Okta Identity Governance.

The company’s Privileged Access product seeks to manage access to “secure hybrid and multi-cloud infrastructure resources” through a central system, and prevent the theft of data within an organization.

Okta’s Identity Governance seeks to deliver administration and governance of self-service identity within the organization through a “single control plane” in hybrid and multi-cloud environments. According to a CNBC report, Okta’s CEO Todd McKinnon believes that the addition of these products is expected to increase the company’s opportunity for business by more than 20%.

The company also announced the expansion of its Integration Network across the areas of data privacy and compliance, risk and fraud, software development lifecycle and customer data orchestration. (See Okta stock analysis on TipRanks)

The CNBC report also quoted McKinnon as saying, “We have a massive addressable market. As everything moves to the cloud, as companies need to connect with their customers through digital channels, as everyone is worried about security, this massive $80 billion TAM (total addressable market) is the foundation for sustained growth for a long time period.”

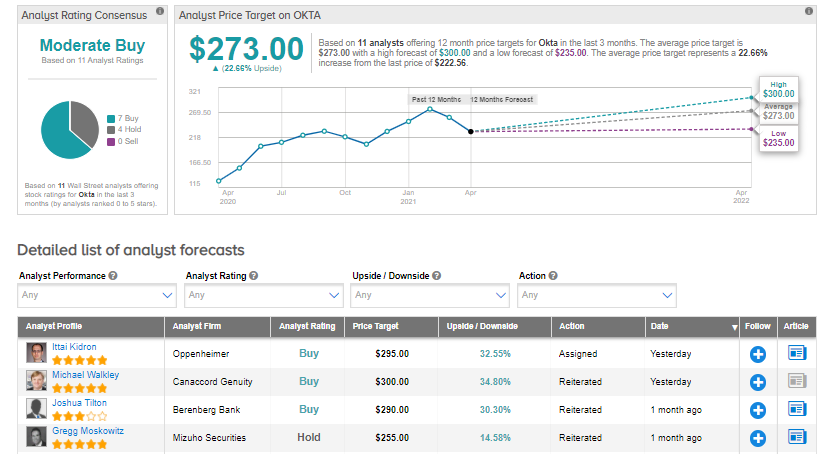

Following the Investor Day presentation, Oppenheimer analyst Ittai Kidron assigned a Buy rating and a price target of $295 on the stock. Kidron said in a research note, “We come away bullish taking into account Okta’s expansion into new market adjacencies and range of growth opportunities tied to secular themes, GTM [go-to-market] investments, and its strong competitive positioning.”

“Key highlights include: (1) entry into two new market adjacencies (PAM [privileged access] and IGA [identity governance], both available in 1Q22), (2) a growing and fast-expanding TAM (to $80B); (3) targeted GTM strategy centered around international expansion and focus on large G2K enterprises; and (4) more insight on the Auth0 acquisition and related synergies. While execution and scaling remain concerns, we believe Okta is strongly positioned to capitalize on the aforementioned opportunities and exceed its +35% revenue growth (with Auth0),” Kidron added.

The rest of the Wall Street community is cautiously optimistic on the stock with a Moderate Buy consensus rating. That is based on 7 analysts suggesting a Buy and 4 analysts recommending a Hold. The average analyst price target of $273 implies around 22.6% upside potential to current levels.

Related News:

Best Buy Launches $200 Per Year Membership Program

Norwegian Cruise Line Unveils Plan To Resume Cruising

Shell Expects To Take A $200M Hit From Texas Winter Storm