Oasis Petroleum (OAS) has reached an agreement for the sale of its entire Permian basin portfolio. The company has sold its entire position for a total potential consideration of $481 million. $406 million will be paid upon the closing of the deal, with three additional $25 million payments dependent on West Texas Intermediate (WTI) prices averaging $60 a barrel in each calendar year from 2023 to 2025.

Once the sale is complete, Oasis Petroleum will focus on the Williston Basin, where it plans to drive value creation through scale and robust inventory life. The sale will also allow the company to align its core competitive strengths.

Additionally, the sale will reduce OAS’ pro-forma leverage to about 0.3x based on first-quarter annualized Adjusted EBITDA.

Chief Executive Officer Danny Brown expects the exit from the Permian Basin to result in substantial value from an asset that was difficult to scale. (See Oasis Petroleum stock analysis on TipRanks)

Brown stated, “The combined Williston and Permian transactions are highly accretive, position Oasis to take advantage of expanded scale, result in very low leverage, and demonstrate our commitment to shareholders. We believe Oasis represents a compelling investment opportunity, and we will continue to be aggressive in pursuing strategies to unlock value.”

Equity Research analyst Tom Hughes has reiterated a Sell rating on the stock. The analyst has a $78 price target on the stock implying 2.5% downside potential to current levels.

In an exploration sector report, Wells Fargo states that OAS stock could outperform if risks related to the Dakota Access Pipeline (DAPL) are fully mitigated. The report further reads, “Investor concern over DAPL has abated recently, however it remains an ongoing risk for Bakken producers. For investors looking to gain Bakken exposure, we find better risk/reward in other names such as WLL and CLR.”

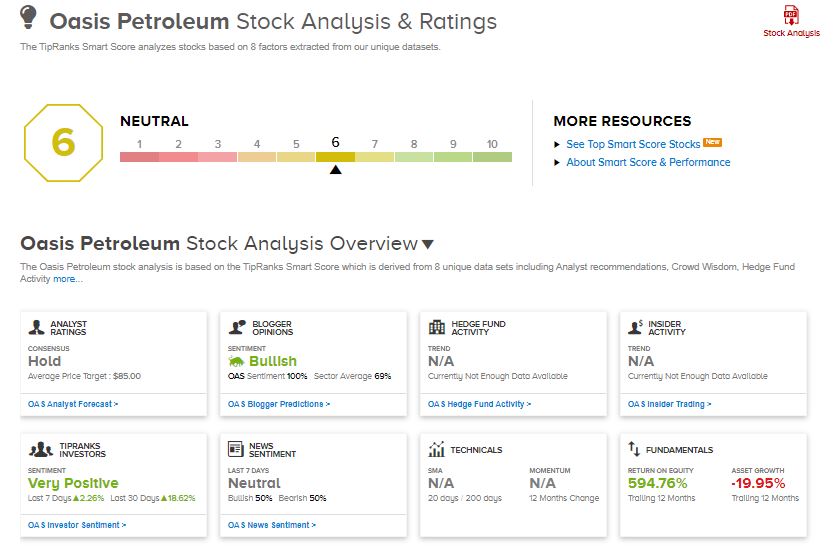

Consensus among analysts on Wall Street is a Hold based on 1 Buy, 1 Hold, and 1 Sell ratings. The average analyst price target of $85 implies 6.25% upside potential to current levels.

OAS scores a 6 out of 10 on TipRanks’ Smart Score rating system, implying its performance is likely to align with market averages.

Related News:

Alphabet’s Waymo Raising $4B Amid IPO Talks – Report

Ford and SK Innovation Ink Battery Cell Manufacturing Joint Venture

Twitter Launches Verification Process for the Blue Checkmark