Shares in Nordstrom are down more than 5% in the pre-market session as the company reported a bigger quarterly loss than expected amid a surge in Covid-19 cases, which kept its stores shut for half of the reported quarter.

The stock is declining to $14.75 in Wednesday’s pre-market trading after Nordstrom (JWN) posted a second-quarter net loss of $255 million, or $1.62 per share, versus a profit of $141 million, or 90 cents per share, in the year-earlier period. Analysts had forecast a loss of $1.48 per share. The retailer said that the larger loss included COVID-19-related charges of $0.08 or $23 million, primarily associated with corporate asset impairments.

Total sales in the quarter ended Aug. 1, dropped 52% to $1.86 billion and was short of the Street consensus for $2.38 billion. The company said that sales were dented by extended store closures along the East and West Coast that have been more impacted by COVID-19.

Due to the surge in COVID-19 cases, Nordstrom saw a deceleration in store traffic in July. In addition, digital sales declined by 5%, as the company moved its Anniversary sale event from Q2 into Q3.

“At the onset of the pandemic, we focused on protecting and enhancing liquidity, and we successfully executed on these plans,” said Nordstrom CEO Erik Nordstrom. “We further strengthened our balance sheet with liquidity of $1.3 billion and generated operating cash flow of more than $185 million. We are now pivoting to prioritize market share gains and profitable growth as we advance our strategies.”

Since mid-March, the family-run retailer has implemented a number of cost-cutting measures including furloughs, reduction in overhead costs, inventory management, and the liquidity management in a move to improve financial flexibility.

Nordstrom shares have been hit hard with the stock plunging 62% this year. Guggenheim analyst Robert Drbul reiterated a Hold rating on the stock following the 2Q results, saying that shares are “fairly valued at today’s levels (~13x our updated 2021E EPS of $1.20)”.

“We think JWN has a sizable online business (54% of 1Q19 sales; 61% in 2Q20) and key strength in its exposure to the off-price space,” Drbul wrote in a note to investors. “While we continue to hold a favorable view on Off-Price, we believe JWN’s offerings lag peers such as TJX, ROST, and BURL.” (See Nordstrom stock analysis on TipRanks).

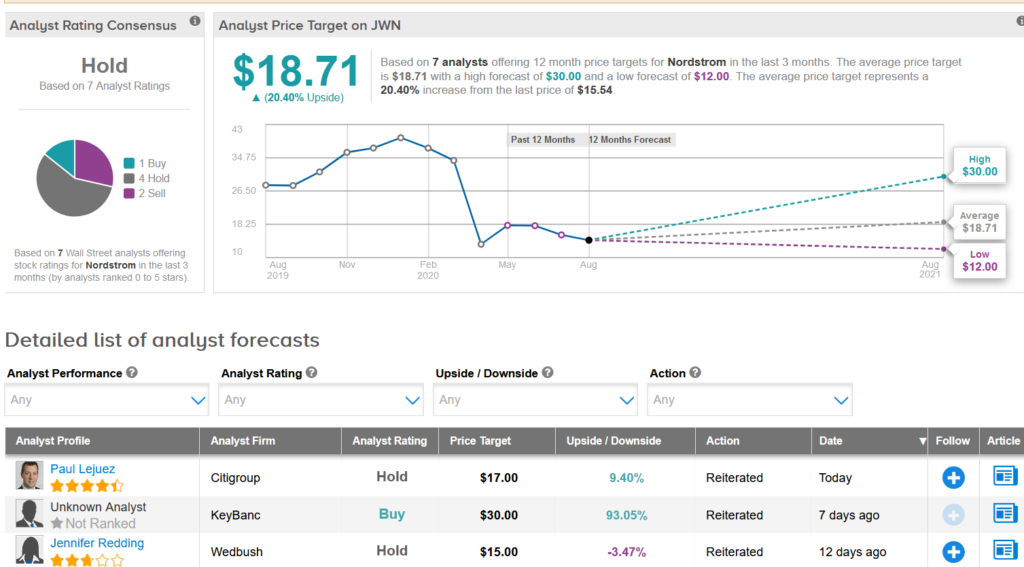

In line with Drbul, the rest of the Street is sidelined on the stock with a Hold consensus. The $18.71 average analyst price target reflects 20% upside potential in the shares over the next 12 months.

Related News:

Bed Bath Cuts 2,800 Jobs In Reshuffle To Boost Online Sales

Northland Cuts AMD To Hold Due To ‘Negative’ Catalysts

Cisco Buying BabbleLabs To Boost Video Meeting Experience

This article was originally posted on TipRanks