Chinese electric vehicle (EV) company Nio on Thursday announced the launch of its new battery service which will allow drivers to buy an EV at a lower price by subscribing to the battery pack separately.

Under Nio’s (NIO) so-called Battery as a Service (BaaS) subscription model, drivers purchasing an EV pay a monthly fee for the battery pack. If users choose to purchase an ES8, ES6 or EC6 model and subscribe to use the 70 kWh battery pack under the BaaS model, they get a RMB70,000 deduction off the original vehicle price and pay a monthly subscription fee of RMB980 for the battery pack. All customers who purchase Nio vehicles are now eligible to place orders with the BaaS model.

“The BaaS model has long been planned with our unique battery swap technologies. The successful launch of the BaaS model will enable Nio users to benefit from the lower initial purchase prices of our products, flexible battery upgrade options and assurance of battery performance,” said Nio CEO William Bin Li. “As of today, Nio has deployed 143 battery swap stations across 64 cities in China, and completed over 800,000 battery swaps for our users.”

“The advantages of our chargeable, swappable and upgradable battery swap technologies will continue to enhance competitiveness of Nio products, promote conversion to our premium smart EVs and create more values for our users,” Bin Li said.

Nio confirmed that drivers will continue to be eligible for existing policies such as purchase tax exemption and government subsidies for EVs. In addition, the EV maker said that the first vehicle under the BaaS model has completed the process of license plate registration, insurance purchase, and auto financing.

For the supply of the batteries, Nio formed the Battery Asset Co. together with partners including Contemporary Amperex Technology Co. and Hubei Science Technology Investment. Nio and its partners will each invest RMB200 million and hold 25% equity interest in the Battery Asset Co., which will purchase and own the battery assets, and lease the battery packs to users who subscribe to the BaaS model.

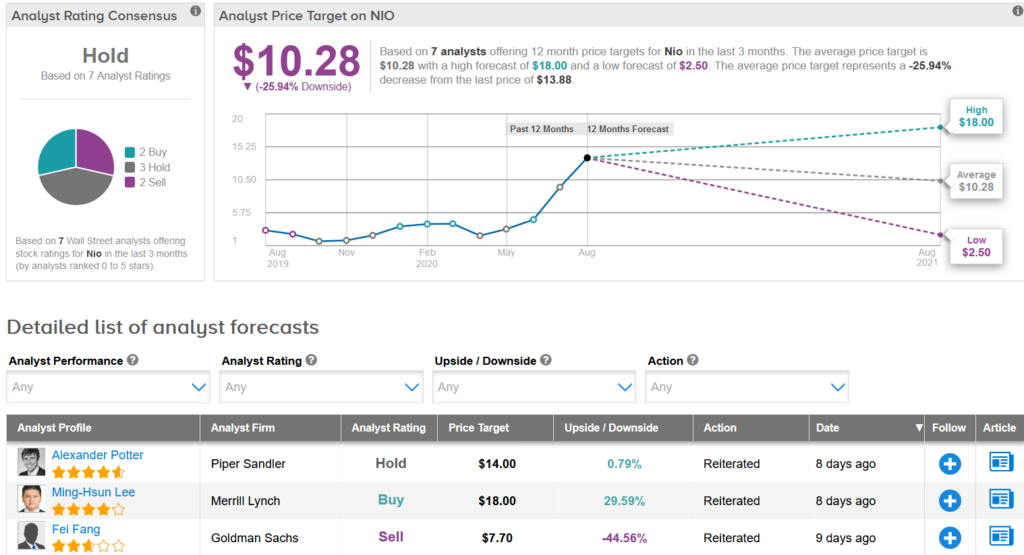

Shares in Nio have exploded 250% so far this year and, as a result, analysts have a cautious Hold consensus on the stock’s outlook. That’s with a $10.28 average analyst price target (26% downside potential).

Goldman Sachs analyst Fei Fang earlier this month reiterated a Sell rating on the stock with a $7.70 price target due to valuation.

“NIO is expensive by traditional valuation metrics. The company isn’t expected to be profitable soon,” Fang wrote in a note to investors. “NIO, of course, is growing rapidly which is one reason it gets a higher than average valuation.”

Related News:

Tesla or Nio: Which EV Company is Geared to Race Ahead?

Plug Power Plunges 7% After-Hours On $300M Public Offering

Tesla Rises 6% In After-Hours On 5-for-1 Stock Split