Electric truck startup Nikola said that it is continuing its discussions to try and ink a $2 billion deal with General Motors, sending its shares up 2.3% in Monday’s after-market trading.

Nikola (NKLA) said that the strategic partnership transaction announced on Sept. 8 has not closed and that it will provide further updates on the deal when appropriate or required. According to the deal, GM would take an 11% stake in the company as part of a partnership to build electric pickup trucks.

Speculation around the success of the deal was triggered by a report published on Sept. 10 by short-seller Hindenburg Research, which accused Nikola of being an “intricate fraud built on dozens of lies” and of misleading investors about its business prospects. As a result, the stock has plunged 58% over the past three months but is still up 81% on a year-to-date basis. (See NKLA stock analysis on TipRanks)

Nikola, which has not yet produced or sold any vehicles, provided the GM update as the startup released its third-quarter results. In the three months ended Sept. 30, the company reported an adjusted loss of $0.16 per share, while analysts had forecasted a loss of $0.20.

During the reported quarter, Nikola said it started together with IVECO, (a CNH Industrial brand) to assemble the first 5 Nikola Tre BEV electric prototype trucks at IVECO’s industrial complex in Germany, and recently completed the assembly of the first Nikola Tre. Nikola anticipates these vehicles to be finished by the end of 2020 and is on track to begin production in the fourth quarter of 2021, it said.

“In the third quarter of 2020, Nikola made significant progress on key milestones,” said Nikola’s CEO Mark Russell. “We delivered on our commitment to assemble the first Nikola Tre BEV prototypes and are continuing to work with customers on the prospective and previously announced BEV truck orders. I look forward to building on our momentum as we execute our strategy and lay the groundwork to become an integrated zero-emissions transportation solutions leader.”

Nikola ended the quarter with a cash position of $908 million, net of $15 million in restricted cash.

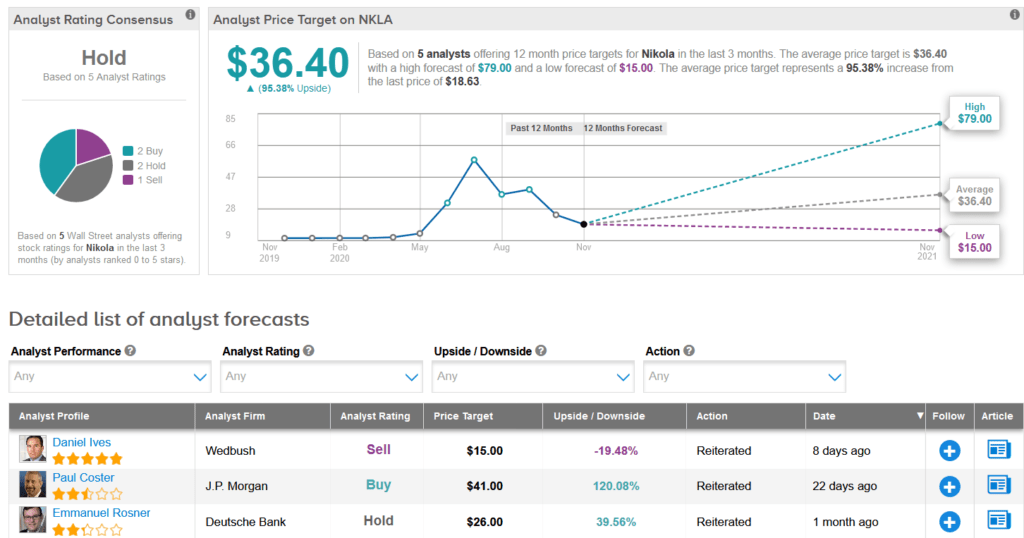

Ahead of the earnings release, Wedbush analyst Daniel Ives maintained a Hold rating on the stock with a $15 price target ($19.5% downside potential), saying that NKLA needs to regain investor credibility one step at a time, although clear challenges remain ahead.

“With Nikola essentially a pre-revenue company at this point, its all about the management team laying out the execution, timetable, and build out strategy for its EV/Hydrogen fuel cell roadmap,” Ives wrote in a note to investors. “Overall we still believe the company’s EV and hydrogen fuel cell ambitions are attainable in the semi-truck market, although we have serious concerns that the execution and timing of these ambitious goals stay on track over the coming years.”

For now, NKLA has 5 analysts covering the stock, who are divided between 2 Holds, 1 Sell and 2 Buys, adding up to a Hold consensus. Looking ahead, the $36.40 average analyst price target puts the upside potential at another promising 95% in the coming months.

Related News:

Alibaba, Richemont To Invest $1.1B In Farfetch For China Push; Stock Up 323% YTD

NextEra Offers $15B To Buy Power Utility Evergy – Report

Orange Buys 54% Stake In Telekom Romania For $318M; Street Sees 29% Upside