Nestlé S.A. has announced that its wholly-owned subsidiary, SPN Merger Sub, has now bought all of the outstanding shares of food-allergy specialist Aimmune Therapeutics.

Nestle said that it has completed the cash tender offer to buy all of the outstanding shares of Aimmune (AIMT), it doesn’t already own at $34.50 per share in cash. Aimmune shares closed at $34.49 on Monday. As of the offer expiration date on Oct. 9 at 12:00 midnight, Eastern time, 43,435,583 shares were tendered, which represents, when added to the shares already owned by Nestlé and its wholly-owned subsidiaries, approximately 84% of the outstanding shares. In addition, Aimmune shareholders have also agreed to the takeover offer.

“The minimum tender condition to the consummation of the Offer set forth in the Offer to Purchase has been satisfied,” Nestlé said in a statement.

Back in August, Nestlé announced the takeover offer at a fully-diluted equity value of $2.6 billion. The deal is expected to be accretive to the company’s organic growth in 2021 and accretive to cash earnings by 2022/23.

Aimmune’s Palforzia is the first and only FDA-approved treatment to help reduce the frequency and severity of allergic reaction to peanuts, including anaphylaxis, in children aged 4 through 17.

Up to 240 million people worldwide suffer with food allergies, peanut allergy being the most common. Palforzia offers a long sought-after solution for peanut-allergic patients other than avoidance.

Shares in AIMT have surged 122% over the past three months and are up 3.1% year-to-date. (See Aimmune stock analysis on TipRanks)

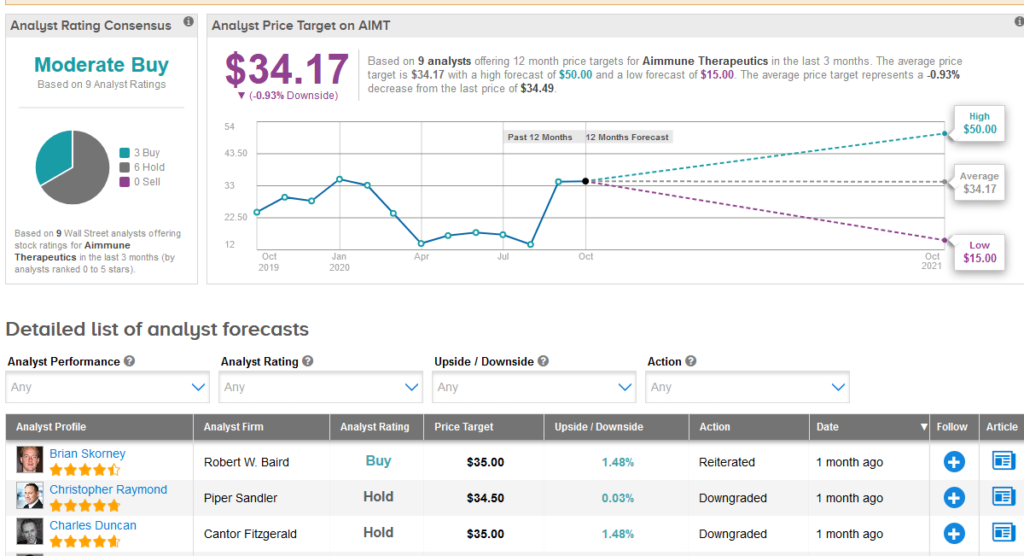

Piper Sandler analyst Christopher Raymond downgraded the stock to Hold from Buy and slashed the price target to $34.50 from $60 following the takeover news.

“Longer-term holders are likely to view this deal as somewhat anticlimactic given that the deal price only brings the stock back to flat on the year,” Raymond wrote in a note to investors.

The analyst supports the short-term decision to sell, but thinks that in the longer-term it will be seen that Nestlé “got itself quite a bargain”.

The rest of the Street is cautiously optimistic on the stock. The Moderate Buy analyst consensus shows 3 recent Buy ratings vs 6 Hold ratings. Meanwhile, the average analyst price target of $34.17 implies that shares are more than fully priced at current levels.

Related News:

Twilio Stock Gains 7.7% On $3.2B Segment Deal; Street Stays Bullish

Bandwidth Snaps Up Voxbone In $527M Cloud Communications Deal; Shares Rise 4%

J&J Halts Covid-19 Vaccine Trial Due To ‘Unexplained Illness’