National Instruments Corp. (NATI), a Texas-based software provider, has entered into a definitive agreement to acquire OptimalPlus Ltd., a global data analytics software company, in a deal valued at $365 million.

With the acquisition, National Instruments seeks to expand its enterprise software offerings to provide customers with business-critical insights through advanced product analytics across their product development flow and supply chain. The company’s automated test systems are used in semiconductor manufacturing to solve engineering challenges.

The deal which is expected to close in early Q3, is still subject to customary closing conditions, including regulatory approval. National Instruments plans to fund the transaction through a combination of cash on hand and debt.

“The addition of OptimalPlus’ data analytics capabilities will enable us to accelerate our growth strategy by increasing enterprise-level value for shared customers in the semiconductor and automotive industries,” said National Instruments President and CEO Eric Starkloff. “During this age of digital transformation, we remain committed to delivering innovative software and systems that leverage a robust data platform to address our customers’ business challenges.”

OptimalPlus, which provides data analytics for the semiconductor, automotive and electronics industries, generated $51 million in revenues in 2019 and employs about 240 employees. Due to the highly complementary nature of the two companies, there will be minimal cost synergies from this transaction, National Instruments said.

Shares in National Instruments, which plunged to a multi-year low in March, have since gained more than 45%. The stock advanced 1.8% to $40 in early midday trading on Tuesday.

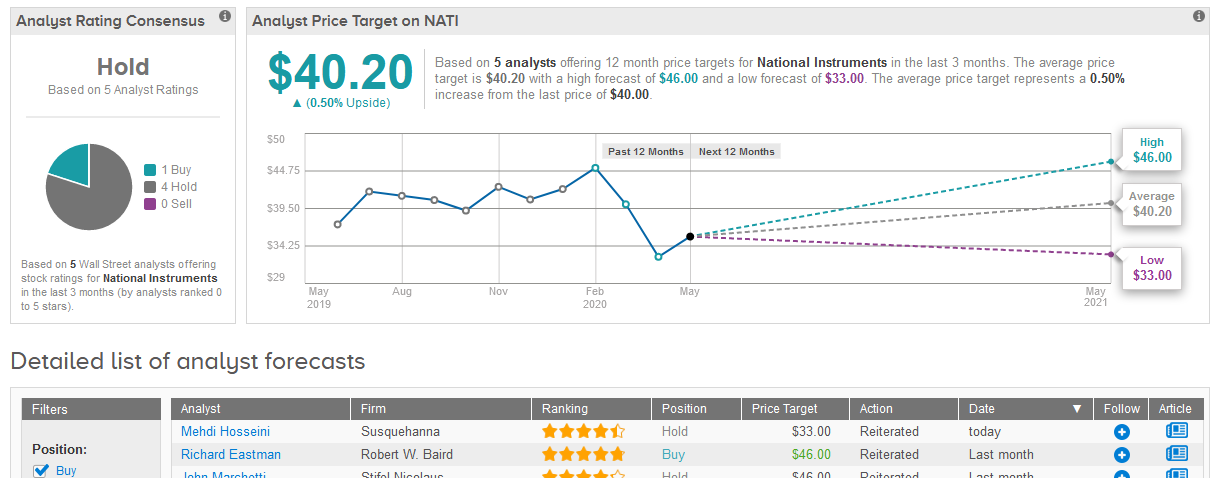

Following the announcement of the deal, five-star analyst Mehdi Hosseini at Susquehanna reiterated a Hold rating on the stock with a $33 price target, saying that it is an “expensive acquisition especially since it won’t become accretive for two years as the primary focus will be on revenue growth”.

“Their $365 million valuation seems high at 7x FY19 revenues, but we await additional color to see how this plays out,” Hosseini said in a note to investors.

Overall, Wall Street analysts have a cautious outlook on the stock. The Hold consensus is based on 4 Hold versus 1 Buy rating. Following the recent sharp rally, the $40.20 average price target means analysts see shares as almost fully priced. (See National Instruments stock analysis on TipRanks).

Related News:

Nordson Buys Fluortek To Offer Tubing Components For Medical Devices

Google Mulling Purchase of Stake in Indian Vodafone Idea

FB Holds ‘Productive’ Call With Trump, As Social Media War Rages On